A) Stock dividends are reported on the income statement.

B) Stock dividends are reported on the Statement of Stockholders' Equity.

C) Stock dividends increase total stockholders' equity.

D) Stock dividends decrease total stockholders' equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an IPO on May 1,2009,Timmy Hilfigure purchased 1,000 shares of Abner Crummie,Inc.for $5,000.On April 30,2015,Timmy Hilfigure sold the 1,000 shares for $8,000 to Ralph Loring.What is the effect of the sale on April 30,2015?

A) Abner Crummie, Inc. will record a $3,000 loss.

B) Abner Crummie, Inc. will record a $3,000 gain.

C) Abner Crummie, Inc. will not be directly affected by this transaction.

D) Abner Crummie, Inc. will record a decrease in Cash of $8,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A partnership:

A) has two or more co-owners.

B) is a not-for- profit business .

C) is incorporated.

D) is a separate legal entity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following events would not require a journal entry on a corporation's books?

A) 2-for-1 stock split

B) 100% stock dividend

C) 2% stock dividend

D) $1 per share cash dividend

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is generally classified as stockholders' equity under both GAAP and IFRS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contributed capital totals $30,000,Retained Earnings equals $65,000,Treasury Stock equals $18,000,and Common Stock equals $10,000.If the company does not have any accumulated other comprehensive income (loss) ,stockholders' equity,what is the total amount of stockholders' equity?

A) $113,000

B) $77,000

C) $123,000

D) $87,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of outstanding shares after these transactions have been accounted for is:

A) 8 million shares.

B) 20 million shares.

C) 10 million shares.

D) 9 million shares.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically,a profitable company that pays little or no dividends:

A) is a bad investment.

B) will reinvest profits which can lead to greater growth potential.

C) will experience relatively stable stock prices over time.

D) will appeal to investors who desire distributions of profit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the declaration and payment of cash dividends is correct?

A) Declaration and payment of cash dividends will reduce the amount of net income.

B) Declaration and payment of cash dividends will not reduce the Retained Earnings balance.

C) Declaration and payment of cash dividends will reduce the amount of cash available to invest in assets.

D) Declaration and payment of cash dividends is calculated on the amount of shares of stock issued, not the amount of shares outstanding.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

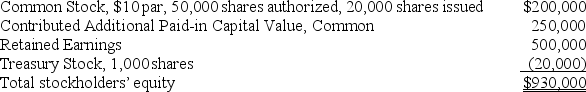

Marble Corporation had the following balances in its stockholders' equity accounts at December 31,2015:

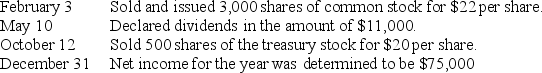

The following transactions occurred during 2016:

The following transactions occurred during 2016:

?Required:

Based on the above information,prepare a statement of stockholders' equity for 2016.

?Required:

Based on the above information,prepare a statement of stockholders' equity for 2016.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells 1 million shares of common stock with no par value for $15 a share.In recording the transaction,it would debit:

A) Cash and credit Additional Paid-in Capital for $15 million.

B) Cash and credit Common Stock for $15 million.

C) Common Stock and credit Cash for $15 million.

D) Common Stock and credit Additional Paid-in Capital for $15 million.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company issues 12 million shares to investors and later repurchases 3 million shares.The number of issued shares after these transactions have been accounted for is:

A) 12 million shares.

B) 11 million shares.

C) 9 million shares.

D) 5 million shares.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EPS is a good predictor of:

A) future interest costs.

B) financial leverage.

C) future cash receipts.

D) future stock prices.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

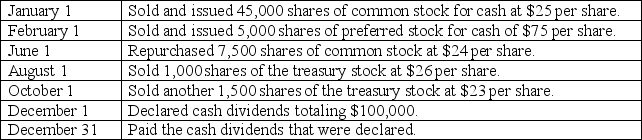

Tyler Corporation was organized in 2015.Its corporate charter authorized the issuance of 50,000 shares of common stock,par value $5 per share,and 10,000 shares of 8% preferred stock,par value $25 per share.The following transactions took place during 2015:

Required:

Part a.Prepare journal entries for each of the following transactions:

Part b.Compute the number of shares of common stock issued and outstanding at December 31,2015.

Required:

Part a.Prepare journal entries for each of the following transactions:

Part b.Compute the number of shares of common stock issued and outstanding at December 31,2015.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation's board of directors could prefer a stock split to a stock dividend because a stock split:

A) increases the market price of the stock.

B) reduces Retained Earnings, so the company pays less taxes.

C) does not reduce Retained Earnings, so it does not reduce the ability to declare a cash dividend in the future.

D) increases total stockholders' equity and allows the corporation more flexibility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

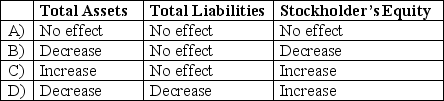

What effect does the purchase of treasury stock have on the balance sheet?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return on equity ratio is calculated as:

A) dividends paid divided by the average book value of stockholders' equity.

B) net income divided by the average number of outstanding common shares.

C) dividends divided by the average number of total shares.

D) (net income less preferred dividends) divided by average common stockholders' equity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earnings per share (EPS) can be affected by all of the following except:

A) how the company chose to finance its operations.

B) the method of depreciation.

C) the inventory costing method.

D) classification of debt as current or long-term.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Large stock dividends are recorded at ______ and small stock dividends are recorded at ______.

A) cost; par value

B) par value; market value

C) par value; par value

D) cost; cost

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a stock dividend is to:

A) decrease total assets and stockholders' equity.

B) change the composition of stockholders' equity.

C) decrease total assets and total liabilities.

D) increase the market value per share of common shares.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 253

Related Exams