A) inventory items being transported from a seller to a buyer.

B) always included in the transportation company's inventory.

C) always included in the selling company's inventory.

D) always included in the buying company's inventory.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following companies would be least concerned about a low inventory turnover ratio?

A) A fish market selling fresh fish

B) A hardware company selling drywall screws

C) A dairy company selling butter and milk

D) A semiconductor company selling microchips

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

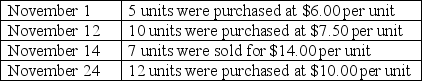

A company uses a weighted-average perpetual inventory system.The following transactions took place during the month of November:

What is the per-unit value of ending inventory on November 30 if this company uses a weighted-average perpetual inventory system? (Round each per unit cost to two decimal points.)

What is the per-unit value of ending inventory on November 30 if this company uses a weighted-average perpetual inventory system? (Round each per unit cost to two decimal points.)

A) $6.00

B) $7.00

C) $8.80

D) $13.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory levels increase by 10% at your company during the fourth quarter.Based on this increase,which of the following statements must be correct?

A) This must be good news because inventories are an asset to the company.

B) This could be good news if the company is ordering more goods because sales appear to be rising.

C) This could be bad news if the company is ordering more goods because unit costs are falling.

D) This must be bad news because higher inventories mean higher costs.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

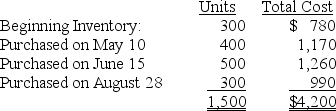

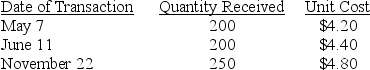

Bailey Company uses a periodic inventory system and its inventory records contain the following information:

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

-Use the information above to answer the following question.If Bailey Company uses the LIFO costing method,what is the cost of its ending inventory?

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

-Use the information above to answer the following question.If Bailey Company uses the LIFO costing method,what is the cost of its ending inventory?

A) $1,365

B) $1,494

C) $1,620

D) $2,835

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Valuing inventory under LIFO may produce different results depending on whether a perpetual or periodic inventory system is used.

B) Valuing inventory under the weighted average cost method always produces the same results using either a perpetual or periodic inventory system.

C) Valuing inventory under FIFO may produce different results depending on whether a perpetual or periodic inventory system is used.

D) Using the specific identification method will produce different results depending on whether perpetual or periodic inventory system is used.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Probes,Inc.wrote down its inventory to the lower replacement value.The effect on Probes' accounting equation includes a(n) :

A) increase in assets.

B) decrease in assets.

C) increase in liabilities.

D) increase in stockholders' equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the FIFO cost method,what is the cost of goods sold for January?

A) $17,250

B) $16,500

C) $18,750

D) $18,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

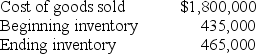

The records of Alberta Inc.included the following information:

-Use the information above to answer the following question.What is the inventory turnover ratio?

-Use the information above to answer the following question.What is the inventory turnover ratio?

A) 3.87 times

B) 4.00 times

C) 4.14 times

D) 2.00 times

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Specific identification is the most practical, but least accurate, measure of cost and net income.

B) When unit costs are increasing, the weighted average cost method yields a cost of goods sold between that of FIFO and LIFO.

C) FIFO will lead to the highest net income if unit costs are falling.

D) LIFO will always yield a smaller net income than FIFO.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Vito,Inc.has an inventory turnover ratio of 5 times,its days to sell must be:

A) 73 days.

B) 73 times per year.

C) 14 days.

D) 14%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

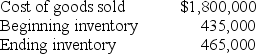

The records of Alberta Inc.included the following information:

-Use the information above to answer the following question.What is the number of days to sell?

-Use the information above to answer the following question.What is the number of days to sell?

A) 91.25 days

B) 94.30 days

C) 88.16 days

D) 182.50 days

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market value of inventory drops below the cost recorded in the financial records,applying the lower of cost or market (LCM) rule causes:

A) a decrease in cost of goods sold.

B) no change in net income, other things being equal.

C) a decrease in total assets.

D) an increase in net income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A declining inventory turnover ratio may mean that:

A) goods are not selling as fast as they were in the past.

B) the company is expecting to sell more in the future.

C) goods are selling, but it is taking longer to collect payment.

D) goods cannot be shipped fast enough.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a periodic inventory system is used.Which inventory costing method generally results in the most recent costs being assigned to ending inventory?

A) LIFO

B) FIFO

C) Weighted average cost

D) Simple average cost

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An understatement of beginning inventory causes net income to be understated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Farley Corporation starts the year with a beginning inventory of 3,000 units at $5 per unit.The company purchases 5,000 units at $4 each in February and 2,000 units at $6 each in March.Farley sells 1,500 units during this quarter.Farley has a perpetual inventory system and uses the FIFO inventory costing method.What is the cost of goods sold for the quarter?

A) $6,000

B) $9,340

C) $7,500

D) $9,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardware Inc.has a periodic inventory system and uses the weighted average method.The company began the year with 150 large brass switch plates on hand at a cost of $4.00 each.Purchases of switch plates during the year were as follows:

The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

A) $3,990

B) $2,508

C) $2,480

D) $2,560

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about inventory costing methods is correct?

A) A change in inventory method is allowed only if it improves the accuracy of the company's financial results.

B) During a period of rising prices, LIFO results in a higher income tax expense than does FIFO.

C) International Financial Reporting Standards (IFRS) allow the use of LIFO but not FIFO.

D) In the U.S., if a company uses LIFO on the income tax return, it may use a different method for financial reporting.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

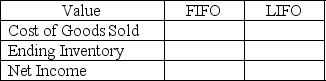

Essay

Assume that the cost of inventory is decreasing.

Required:

Fill in the blanks below with the words "higher" and "lower" to indicate which inventory costing method causes the value to be higher and which causes it to be lower.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 214

Related Exams