A) A flat tax raises more revenue that a regressive tax.

B) A flat tax removes the incentives for tax avoidance through loopholes and other mechanisms.

C) Estonia and Russia have abandoned the use of a flat tax because they were unable to administer it.

D) When a flat tax rate is combined with a threshold that exempts some income, the rich will pay less under a flat tax system than they do under the present U.S.system.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses arise because a tax causes some individuals to change their behavior.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

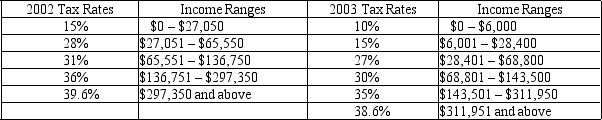

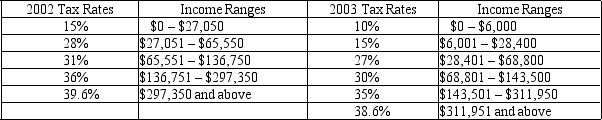

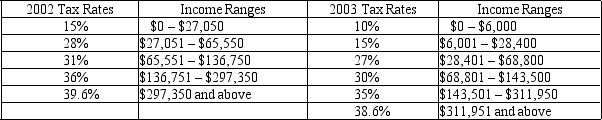

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What happened to her average tax rate between 2002 and 2003?

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What happened to her average tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in 2012 the average citizen's federal tax bill is $4,872,and total federal spending is $6,532 per person.In 2012,the federal government will have

A) a budget surplus.

B) a budget deficit.

C) horizontal equity.

D) vertical equity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The U.S.tax burden is high compared to many European countries,but is low compared to many other nations in the world.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax minimizes deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What is her marginal tax rate in 2002?

-Refer to Table 12-2.Surbhi is a single person whose taxable income is $150,000 a year.What is her marginal tax rate in 2002?

A) 15%

B) 28%

C) 31%

D) 36%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) All states have state income taxes, but the percentages vary widely.

B) Sales taxes and property taxes are important revenue sources for state and local governments.

C) Medicare spending has increased because the percentage of the population that is elderly has increased, as has the cost of health care compared to cost of other goods and services.

D) A budget deficit occurs when government spending exceeds government receipts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of a tax is

A) the reduction in economic welfare of taxpayers that exceeds the revenue raised by the government.

B) the improved efficiency created as people reallocate resources according to the tax incentive rather than the true costs and benefits.

C) the loss in tax revenues.

D) Both a and b are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government taxes labor earnings we can expect people to

A) work more so they can keep the same standard of living.

B) work less and enjoy more leisure.

C) quit their present job and find one that pays better.

D) stop working altogether and go on welfare.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who observed that "in this world nothing is certain but death and taxes"?

A) Mark Twain

B) P.T.Barnum

C) Ben Franklin

D) Richard Nixon

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two families who live in Plains,GA have identical incomes.The Smiths deduct $5,000 from their taxable income for mortgage interest paid during the year.The Jones family lives in an apartment and is not eligible for a mortgage-interest deduction.This situation exemplifies

A) an application of the benefits principle of taxation.

B) a violation of horizontal equity.

C) a violation of vertical equity.

D) an application of egalitarian tax rules.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should be taxed according to their ability to pay.

D) should receive government benefits according to how much they have been taxed.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle is used to justify

A) property taxes.

B) gasoline taxes.

C) "sin" taxes on cigarettes and alcoholic beverages.

D) personal income taxes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing the tax burden of several major countries,the United States's tax burden is

A) the highest.

B) in the top 20 percent.

C) in the middle.

D) near the bottom.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most people agree that the tax system

A) should be both efficient and equitable.

B) cannot raise enough revenue to cover government expenditures.

C) would raise more revenue if tax rates were lowered.

D) should be rewritten to require everyone to pay the same percentage of income in taxes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What happened to his marginal tax rate between 2002 and 2003?

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What happened to his marginal tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

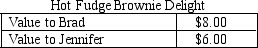

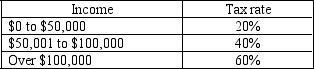

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

A) Jennifer will pay more tax as a percentage of her value of delights than Brad.

B) Brad must pay the $2.00 tax from his consumer surplus.

C) Brad will have to pay a higher price for delights.

D) Jennifer will leave the market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

A) 9.25%

B) 20%

C) 25%

D) 40%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 328

Related Exams