A) $0.

B) $9,750.

C) $15,000.

D) $20,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

An S corporation recognizes a on any distribution of appreciated property.

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities affect the owner's basis differently in an S corporation than they do in a partnership.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fred is the sole shareholder of an S corporation in Fort Deposit, Alabama.At a time when his stock basis is $20,000, the corporation distributes appreciated property worth $100,000 basis of $20,000) .Fred's taxable gain is:

A) $0.

B) $10,000.

C) $80,000.

D) $100,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

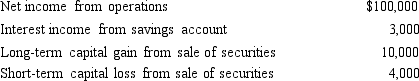

Oxen Corporation incurs the following transactions.  Oxen maintains a valid S election and does not distribute any assets cash or property) to its sole shareholder, Megan.As a result, Megan must recognize ignore 20% QBI deduction) :

Oxen maintains a valid S election and does not distribute any assets cash or property) to its sole shareholder, Megan.As a result, Megan must recognize ignore 20% QBI deduction) :

A) Ordinary income of $103,000.

B) Ordinary income of $103,000 and long-term capital gain of $6,000.

C) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

D) Ordinary income of $109,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which corporation is eligible to make the S election?

A) Non-U.S.corporation.

B) One-person limited liability company.

C) Insurance company.

D) U.S.bank.

E) None of the above can select S status.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A distribution from the other adjustment account OAA) is not taxable to an S shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This year, Jiang, the sole shareholder of a calendar year S corporation, received a distribution of $17,000.On December 31 of the prior year, his stock basis was $3,000.The corporation earned $12,000 ordinary income during the year.It has no accumulated E&P.Which statement is correct? Ignore the 20% QBI deduction.

A) Jiang recognizes a $2,000 LTCG.

B) Jiang's stock basis will be $2,000.

C) Jiang's ordinary income is $15,000.

D) Jiang's return of capital is $11,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is increased by stock purchases and capital contributions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most limited liability partnerships can own stock in an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income at the corporate level flows through as exempt to S shareholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Section 179 expense deduction is a Schedule K item on the Form 1120S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The passive investment income of an S corporation includes net capital gains from the sale of stocks and securities.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

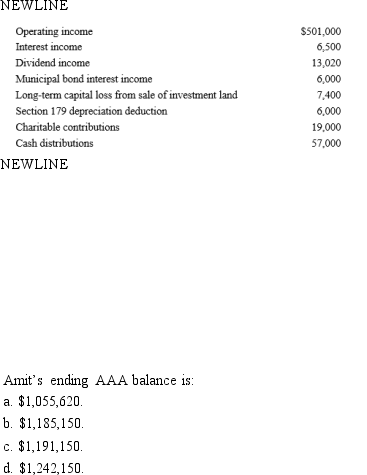

Amit, Inc., an S corporation, holds an AAA balance of $614,000 at the beginning of the tax year.During the year, the following items occur.  E)Some other amount.

E)Some other amount.

Correct Answer

verified

Correct Answer

verified

Essay

The exclusion of on the disposition of small business stock is/is not) available for S stock.

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income at the S corporation level flows through as taxable to the shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation is subject to the following taxes) .

A) Corporate income tax § 11) .

B) Built-in gains tax.

C) Alternative minimum tax.

D) None of the above apply to S corporations.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Depreciation recapture income is a separately, nonseparately) computed amount.

Correct Answer

verified

Correct Answer

verified

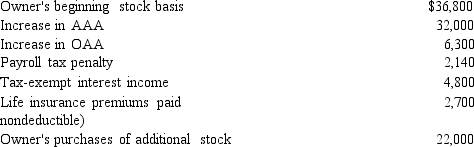

Multiple Choice

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

A) $71,600

B) $74,120

C) $76,220

D) $78,920

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pepper, Inc., an S corporation, holds a $1 million balance in accumulated E&P.It reports sales revenues of $400,000, taxable interest of $380,000, operating expenses of $250,000, and deductions attributable to the interest income of $140,000.What is Pepper's passive income penalty tax payable, if any?

A) $380,000.

B) $116,842.

C) $24,537.

D) $0.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 118

Related Exams