A) products require different ratios of allocation-base usage in each production department

B) significant differences exist in the factory overhead rates used across different production departments

C) both A and B are true

D) neither A nor B are true

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blackwelder Factory produces two similar products - small lamps and desk lamps. The total plant overhead budget is $640,000 with 400,000 estimated direct labor hours. It is further estimated that small lamp production will require 275,000 direct labor hours and desk lamp production will need 125,000 direct labor hours. Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will Blackwelder Factory allocate to small lamp production if actual direct hours for the period is 285,000?

A) $275,000

B) $285,000

C) $440,000

D) $456,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following can be used as an allocation base for calculating factory overhead rates except:

A) direct labor dollars

B) direct labor hours

C) machine hours

D) total units produced

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing can be used to allocate period costs to various products that the company sells.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

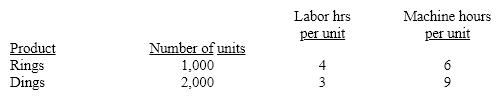

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $105,000.

The Aleutian Company uses departmental overhead rates. The Fabrication Department uses machine hours for an allocation base, and the Assembly Department uses labor hours.

What is the Assembly Department overhead rate per labor hour?

All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $105,000.

The Aleutian Company uses departmental overhead rates. The Fabrication Department uses machine hours for an allocation base, and the Assembly Department uses labor hours.

What is the Assembly Department overhead rate per labor hour?

A) $10.50

B) $19.50

C) $3.75

D) $4.38

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing can only be used to allocate manufacturing factory overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

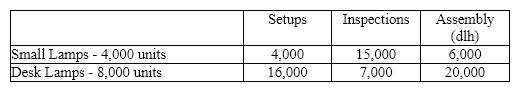

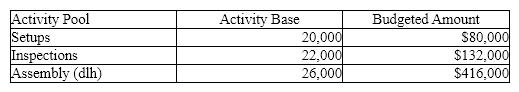

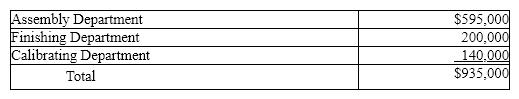

The Bonnington Company manufactures small lamps and desk lamps. The following shows the activities per product:  Using the following information prepared by the Bonnington Company, determine the total factory overhead to be charged to small lamps.

Using the following information prepared by the Bonnington Company, determine the total factory overhead to be charged to small lamps.

A) $314,000

B) $209,333

C) $202,000

D) $104,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using multiple department factory overhead instead of a single plantwide factory overhead rate:

A) results in more accurate product costs

B) results in distorted product costs

C) is simpler and less expensive to compute than a plantwide rate

D) applies overhead costs to all departments equally

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In a service organization, the multiple department overhead rate method is the most effective in providing information about the cost of services.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an effort to simplify the multiple production department factory overhead rate method, the same rate can be used for all departments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the activities causing overhead costs are different across different departments and products, use of a plantwide factory overhead rate will cause distorted product costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing is much easier to apply than single plantwide factory overhead allocation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

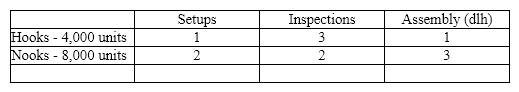

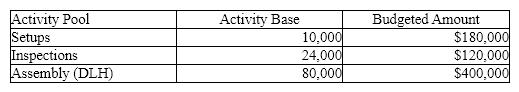

The Skagit Company manufactures Hooks and Nooks. The following shows the activities per product and total activity information:

Calculate the total factory overhead to be charged to each unit of Hooks.

Calculate the total factory overhead to be charged to each unit of Hooks.

A) $33

B) $50

C) $11

D) $61

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity cost pools are assigned to products, using factory overhead rates for each activity.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

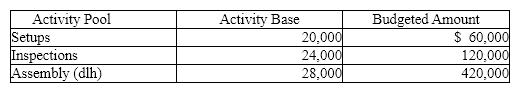

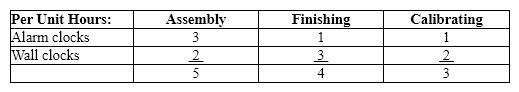

Ratchford Clocks manufactures alarm clocks and wall clocks and allocates overhead based on direct labor hours. The production process is set up in three departments: Assembly, Finishing, and Calibrating. The following is information regarding the direct labor used to produce one unit of the two clocks:  The budget includes the following factory overhead by department:

The budget includes the following factory overhead by department:  Ratchford Clocks is planning to manufacture 50,000 alarm clocks and 10,000 wall clocks.

(a) Determine the total number of hours that will be needed by department.

(b) Determine the factory overhead rate by department using the multiple production department factory overhead rate method.

(c) Determine the amount of factory overhead to be allocated to each unit of alarm clocks and wall clocks.

(d) Determine the amount of total factory overhead to be allocated to the alarm clocks and wall clocks.

Ratchford Clocks is planning to manufacture 50,000 alarm clocks and 10,000 wall clocks.

(a) Determine the total number of hours that will be needed by department.

(b) Determine the factory overhead rate by department using the multiple production department factory overhead rate method.

(c) Determine the amount of factory overhead to be allocated to each unit of alarm clocks and wall clocks.

(d) Determine the amount of total factory overhead to be allocated to the alarm clocks and wall clocks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - Finishing and Production. The overhead budget for the Finishing Department is $550,000, using 500,000 direct labor hours. The overhead budget for the Production Department is $400,000 using 80,000 direct labor hours. If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, what is the total amount of factory overhead the Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 26,000 units are produced?

A) $540,000

B) $187,200

C) $475,000

D) $288,600

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Multiple production department factory overhead rates are most useful when production departments significantly differ in their manufacturing processes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the following information, determine the activity rate for setups.

A) $58.00

B) $18.00

C) $.75

D) $5.09

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity cost pools are cost accumulations associated with a given activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor hours is not a cost pool that is regularly used in the activity-based costing method.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 110

Related Exams