A) distorts incentives.

B) improves efficiency.

C) focuses on middle income brackets.

D) relies on foreign aid to help balance the budget.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When incentives to earn income are distorted by income redistribution programs,

A) losses can exceed potential gains from greater equality of income.

B) total income in an economy can fall.

C) total utility in society can fall.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of a welfare program?

A) Supplemental Security Income (SSI)

B) Temporary Assistance for Needy Families (TANF)

C) food stamps

D) minimum wage laws

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers are transfers to the poor

A) in the form of goods and services rather than cash.

B) in the form of goods, services, and cash.

C) from private charitable organizations only.

D) from the federal government only.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In the United States from 1935 to 2008 the share of total income earned by the bottom fifth of income earners rose and then fell.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs to alleviate poverty would be most favored by philosopher Robert Nozick and why?

A) A negative income tax because it would maximize the minimum income of members of society.

B) An Earned Income Tax Credit (EITC) because a policy that rewards the working poor would be the most just.

C) An in-kind transfer program because it would maximize the total utility of all members of society.

D) None of the programs would be favored because each of them forcibly redistributes income that was fairly, if not equally, earned.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The US government sets the poverty line equal to approximately

A) three times the cost of providing subsidized housing.

B) three times the cost of providing an adequate diet.

C) the minimum wage for a single person working 40 hours per week and 50 weeks per year.

D) the cost of providing food, shelter, and health care expenses for a family of four.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's ability to buy goods and services depends largely on the family's

A) economic mobility.

B) place in the economic life cycle.

C) transitory income.

D) permanent income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The United States has a more equal distribution of income than other developed countries such as Japan and Germany.

B) The statement "a rising tide lifts all boats" illustrates how economic growth reduces the number of people with income levels below the poverty line.

C) The economic life cycle explains why people base spending decisions on transitory income.

D) The United States has more income inequality than some developing countries, such as Mexico and Brazil.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with a minimum wage law to reduce poverty is that it

A) encourages illegitimate births because single women with children receive higher payments.

B) rewards laziness because it provides payments to those with low incomes regardless of their work effort.

C) focuses on children and the disabled while neglecting the working poor.

D) may benefit the teenage children of families who are not poor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data for the United States suggests that about how many millionaires inherited their fortunes?

A) one in seven

B) one in five

C) one in three

D) one in two

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States has more income inequality than

A) Brazil.

B) Mexico.

C) Canada.

D) South Africa.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Toys for Tots, a program that collects new toys to distribute to poor children at Christmas, is an example of an in-kind transfer.

B) Supporters advocate the use of in-kind transfers because they restrict the ability of recipients to purchase alcohol and drugs.

C) Critics argue that in-kind transfers are inefficient and disrespectful.

D) In order for a program to qualify as an in-kind transfer, it must have government approval.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group would be the least upset by wide variation in the income distribution?

A) utilitarians

B) liberals

C) libertarians

D) Each group would be equally upset.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.welfare system was revised by a 1996 law that

A) consolidated all of the previous assistance programs into a single program.

B) limited the amount of time that people could receive assistance.

C) said it was no longer necessary for poor people to demonstrate an additional "need," such as small children or a disability, to qualify for assistance.

D) turned all federally-run welfare programs over to the states.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a government could successfully achieve the maximin criterion,each member of society would have an equal income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with in-kind transfers to reduce poverty is that they

A) are more expensive than a negative income tax.

B) are inefficient because they do not allow poor families to make purchases based on their preferences.

C) focus on children and the disabled while neglecting the working poor.

D) may benefit the teenage children of families who are not poor.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A U.S.family earning $80,000 would be in the top 20 percent of income distribution in 2008.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

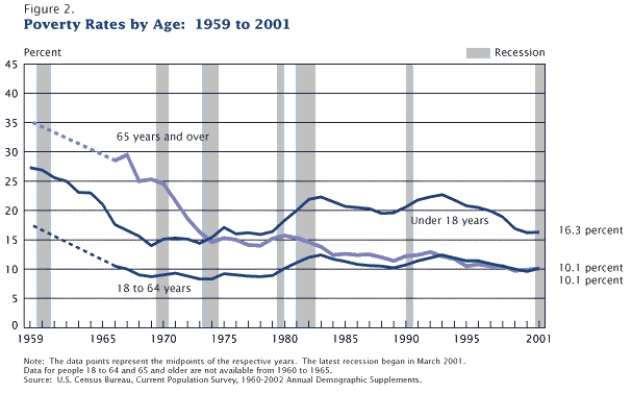

Figure 20-4

Poverty Rates by Age

-Refer to Figure 20-4.In 1968,the percent of elderly aged 65 and over in poverty is

-Refer to Figure 20-4.In 1968,the percent of elderly aged 65 and over in poverty is

A) higher than both the percentage of adults aged 18 to 64 and the percentage of children under age 18 in poverty.

B) higher than the percentage of adults aged 18 to 64 but is lower than the percentage of children under age 18 in poverty.

C) lower than both the percentage of adults aged 18 to 64 and the percentage of children under age 18 in poverty.

D) is lower than the percentage of adults aged 18 to 64 but is higher than the percentage of children under age 18 in poverty.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many Democrats who campaigned in the 2006 elections supported raising the U.S.minimum wage.Critics of raising the minimum wage argue that minimum-wage laws are

A) too expensive for local governments to fund.

B) too expensive for local governments to administer.

C) imprecise in their ability to help the working poor.

D) easy for businesses to pay.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 374

Related Exams