A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 the largest percentage of federal government spending was on

A) national defense. The largest source of federal revenues was from corporate income taxes.

B) national defense. The largest source of federal revenues was from individual income taxes.

C) Social Security. The largest source of federal revenues was from corporate income taxes.

D) Social Security. The largest source of federal revenues was from individual income taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

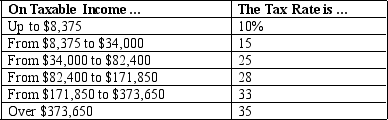

Table 12-1

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her tax liability will be

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her tax liability will be

A) $16,781.

B) $41,309.

C) $41,827.

D) $47,600.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000,your marginal tax rate is

A) 8 percent.

B) 12.5 percent.

C) 20 percent.

D) unknown. We do not have enough information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should be taxed according to their ability to pay.

D) should receive government benefits according to how much they have been taxed.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

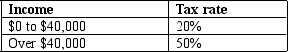

Table 12-5

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An efficient tax system is one that imposes small

A) deadweight losses and administrative burdens.

B) marginal rates and deadweight losses.

C) administrative burdens and transfers of money.

D) marginal rates and transfers of money.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

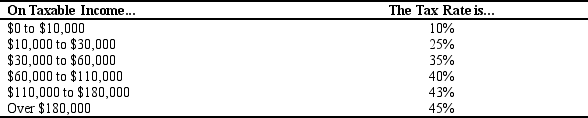

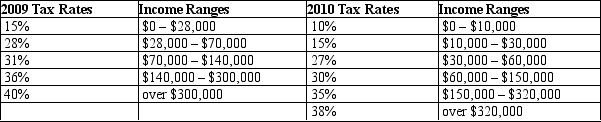

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

A) $105,700

B) $108,900

C) $111,600

D) $117,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

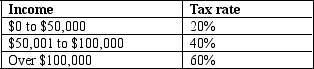

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $120,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High marginal income tax rates

A) distort incentives to work.

B) are used to encourage saving behavior.

C) will invariably lead to lower average tax rates.

D) are not associated with deadweight losses.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-3.Suppose the government levies a tax of $1 on a movie ticket and that,as a result,the price of a movie ticket increases to $6.If Bob and Lisa both purchase a movie ticket,what is the deadweight loss from the tax?

A) $0

B) $1

C) $2

D) $3

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most people agree that the tax system

A) should be both efficient and equitable.

B) cannot raise enough revenue to cover government expenditures.

C) would raise more revenue if tax rates were lowered.

D) should be rewritten to require everyone to pay the same percentage of income in taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.income tax

A) discourages saving.

B) encourages saving.

C) has no effect on saving.

D) will reduce the administrative burden of taxation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who pays a corporate income tax?

A) owners of the corporation

B) customers of the corporation

C) workers of the corporation

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the economy's income has grown,the government has

A) grown at about the same pace.

B) grown at a faster pace.

C) grown at a slower pace.

D) shrunk.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.What type of tax structure did the United States have in 2009 for single individuals?

-Refer to Table 12-12.What type of tax structure did the United States have in 2009 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses and administrative burdens are key factors considered when determining the efficiency of the tax system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget deficit

A) occurs when government receipts are less than spending.

B) occurs when government spending is less than receipts.

C) occurs when government receipts are equal to spending.

D) is the accumulation of years of government overspending.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If Mary earns $80,000 in taxable income and pays $40,000 in taxes,her marginal tax rate must be 50 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 478

Related Exams