A) A only.

B) B or D.

C) C only.

D) A or D.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the United States,all families pay the same proportion of their income in taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight losses because they

A) reduce costs for firms.

B) distort incentives.

C) cause prices to decrease.

D) create revenue for the government.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists define a business's "value added" as

A) the amount the firm pays for goods and services less the revenue from the sale of goods and services.

B) the revenue from the sale of goods and services less the amount the firm pays for goods and services.

C) the total value of the goods and services created by the firm.

D) the value that consumers place on the goods and services created by the firm.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes a situation where tax laws give preferential treatment to specific types of behavior?

A) tax evasion

B) a political payoff

C) a tax loophole

D) compensation for the benefit of society

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some colleges charge all students the same "activity fee." Suppose that students differ by how many campus activities they engage in.This charge is most like

A) an excise tax which conforms to the benefits principle.

B) an excise tax which violates the benefits principle.

C) a lump-sum tax which conforms to the benefits principle.

D) a lump-sum tax which violates the benefits principle.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lump-sum tax

A) is most frequently used to tax real property.

B) does not distort incentives.

C) distorts incentives more than any other type of tax.

D) is the most fair tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

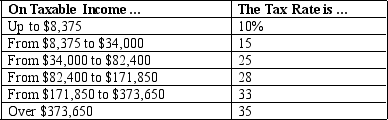

Table 12-1

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her marginal tax rate is

-Refer to Table 12-1.If Betina has $170,000 in taxable income,her marginal tax rate is

A) 25%.

B) 28%.

C) 33%.

D) 35%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

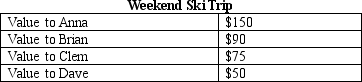

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $75

B) $105

C) $185

D) $215

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As of 2007,the largest source of receipts for state and local governments was corporate income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government spends its revenues in a number of ways.Rank the following spending categories from largest to smallest.

A) Social Security, national defense, income security, net interest

B) health care, national defense, net interest, income security

C) Social Security, health care, national defense, Medicare

D) national defense, Social Security, net interest, income security

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government finances the budget deficit by

A) borrowing from the public.

B) borrowing solely from the Federal Reserve Bank.

C) printing currency in the amount of the budget deficit.

D) requiring that budget surpluses occur every other year to pay off the deficits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Some states do not have a state income tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a cost of taxes to taxpayers?

A) the tax payment itself

B) deadweight losses

C) administrative burdens

D) goods and services provided by the government

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose Roger and Regina receive great satisfaction from their consumption of cheesecake. Regina would be willing to purchase only one slice and would pay up to $8 for it. Roger would be willing to pay $11 for his first slice, $9 for his second slice, and $5 for his third slice. The current market price is $5 per slice. -Refer to Scenario 12-2.Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $9.What is the deadweight loss of the tax?

A) $3

B) $6

C) $8

D) $9

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two taxes that together provide the U.S.federal government with approximately 85 percent of its revenue are

A) individual income taxes and property taxes.

B) individual income taxes and corporate income taxes.

C) individual income taxes and payroll taxes.

D) sales taxes and payroll taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of a "welfare program" is most closely associated with which particular federal government program?

A) spending on medical research

B) Temporary Assistance for Needy Families (TANF)

C) Medicare

D) Social Security

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rates on the richest Americans when Ronald Reagan was elected and left office were

A) 28 percent and 50 percent, respectively.

B) 70 percent and 40 percent, respectively.

C) 40 percent and 70 percent, respectively.

D) 50 percent and 28 percent, respectively.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1789,the average American paid approximately what percent of income in taxes?

A) 5%

B) 15%

C) 33%

D) 50%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following state and local government expenditure categories from smallest to largest.

A) education, public welfare, highways

B) education, highways, public welfare

C) highways, public welfare, education

D) public welfare, education, highways.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 441 - 460 of 478

Related Exams