A) a constant share of income in taxes.

B) a smaller share of income in taxes.

C) a larger share of income in taxes.

D) There is little evidence of a relationship between income and taxes for most countries.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

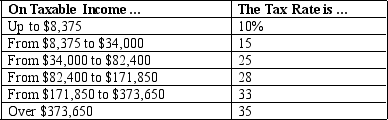

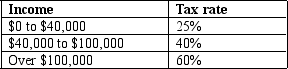

Table 12-1

-Refer to Table 12-1.If Damian has $33,000 in taxable income,his tax liability will be

-Refer to Table 12-1.If Damian has $33,000 in taxable income,his tax liability will be

A) $4,531.

B) $4,678.

C) $4,950.

D) $8,269.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

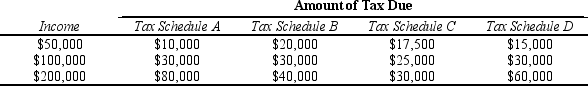

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.Which tax schedules are proportional?

-Refer to Table 12-11.Which tax schedules are proportional?

A) Tax Schedule B only

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule D only

D) Tax Schedule A and Tax Schedule B

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about state income taxes is correct?

A) Some states do not tax income at all.

B) If states tax income, they must follow federal guidelines for designing the tax structure.

C) States are not allowed to have a higher marginal tax rate than the federal marginal tax rate.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has the largest tax burden?

A) Brazil

B) Germany

C) United States

D) Sweden

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,

A) the average tax rate for high income taxpayers will be the same as the average tax rate for low income taxpayers.

B) the average tax rate for high income taxpayers will be lower than the average tax rate for low income taxpayers.

C) the average tax rate for high income taxpayers will be higher than the average tax rate for high income taxpayers.

D) Any of the above could be true under a regressive tax system.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the total surplus lost as a result of a tax is less than the amount of tax revenue collected by the government there is a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

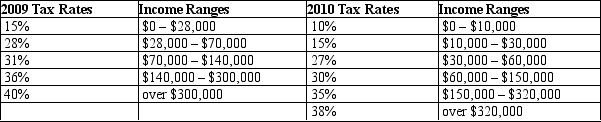

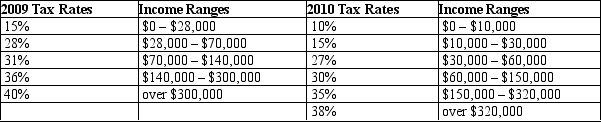

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.What type of tax structure does the United States have in 2010 for single individuals?

-Refer to Table 12-12.What type of tax structure does the United States have in 2010 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States,the marginal tax rate on individual federal income tax

A) decreases as income increases.

B) increases as income increases.

C) is constant at all income levels.

D) applies only to payroll taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.tax code gives preferential treatment to investors in municipal bonds.This is an example of

A) a tax loophole.

B) tax evasion.

C) an administrative burden.

D) tax enforcement.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do some policymakers support a consumption tax rather than an earnings tax?

A) The average tax rate would be lower under a consumption tax.

B) A consumption tax would encourage people to save earned income.

C) A consumption tax would raise more revenues than an income tax.

D) The marginal tax rate would be higher under an earnings tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are transfer payments except

A) Medicaid.

B) unemployment compensation.

C) personal income taxes.

D) Food Stamps.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When taxes are imposed on a commodity,

A) there is never a deadweight loss.

B) some consumers alter their consumption by not purchasing the taxed commodity.

C) tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D) the taxes do not distort incentives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her marginal tax rate in 2010?

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her marginal tax rate in 2010?

A) 15%

B) 27%

C) 30%

D) 35%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A lump sum tax can never have horizontal equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,approximately what percentage of federal government receipts came from individual income taxes?

A) 15%

B) 30%

C) 43%

D) 60%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-6

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $50,000?

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $50,000?

A) 25%

B) 28%

C) 40%

D) 60%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the 2010 calendar year only,the federal estate tax does not exist.Which of the following is not correct?

A) The one year absence of this tax creates peculiar incentives for people with large estates who are nearing the end of their lives.

B) Some people created provisions in their health-care proxies allowing for life support to continue until 2010 so the estate beneficiaries would receive a larger bequest.

C) The estate tax usually applies to about 5,500 taxpayers per year.

D) Before 2010, the estate tax was approximately 20 percent of the total estate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the country of Mankiwland has a new king,King Gregory.For the purpose of efficiency King Gregory's chief economic advisor would encourage him to design his country's tax system to minimize (i) deadweight losses from taxes. (ii) administrative burdens from taxes. (iii) the tax payments themselves. (iv) government expenditures to correct for market failures.

A) (i) only

B) (i) and (ii) only

C) (iii) and (iv) only

D) (i) , (ii) , (iii) , and (iv)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 478

Related Exams