A) $4.

B) $6.

C) $10.

D) $16.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

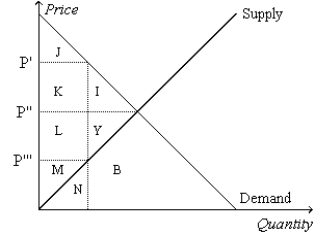

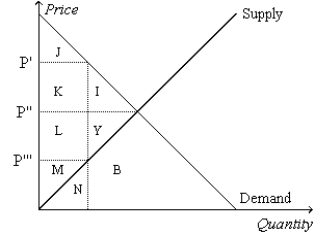

Figure 8-1

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

A) K+L.

B) I+Y.

C) J+K+L+M.

D) I+J+K+L+M+Y.

F) All of the above

Correct Answer

verified

A

Correct Answer

verified

True/False

The more elastic the supply,the larger the deadweight loss from a tax,all else equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose that a university charges students a $100 "tax" to register for business classes.The next year the university raises the "tax" to $150.The deadweight loss from the "tax" triples.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price elasticities of supply and demand affect

A) both the size of the deadweight loss from a tax and the tax incidence.

B) the size of the deadweight loss from a tax but not the tax incidence.

C) the tax incidence but not the size of the deadweight loss from a tax.

D) neither the size of the deadweight loss from a tax nor the tax incidence.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on the buyers of a good,the demand curve shifts

A) downward by the amount of the tax.

B) upward by the amount of the tax.

C) downward by less than the amount of the tax.

D) upward by more than the amount of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed,the loss of consumer surplus and producer surplus as a result of the tax exceeds the tax revenue collected by the government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

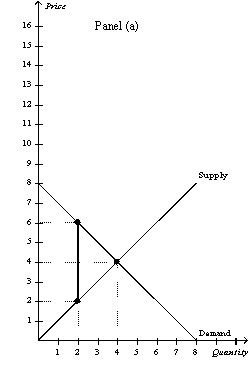

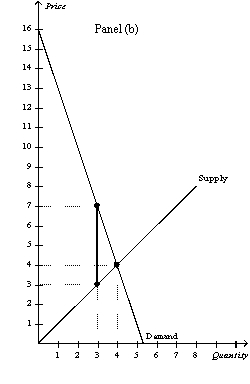

Figure 8-13

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (a) ,Panel (b) illustrates which of the following statements?

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (a) ,Panel (b) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastic.

F) C) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Suppose that the government imposes a tax on dairy products.The deadweight loss from this tax will likely be greater in the

A) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

B) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

C) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

D) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

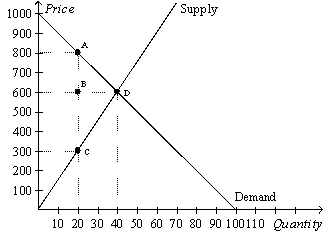

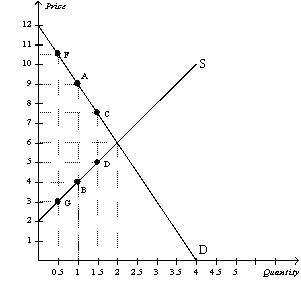

Figure 8-9

The vertical distance between points A and C represent a tax in the market.

-Refer to Figure 8-9.The equilibrium price and quantity before the imposition of the tax is

-Refer to Figure 8-9.The equilibrium price and quantity before the imposition of the tax is

A) P=$800 and Q=20.

B) P=$600 and Q=20.

C) P=$300 and Q=20.

D) P=$600 and Q=40.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

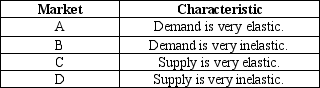

Table 8-1

-Refer to Table 8-1.Suppose the government is considering levying a tax in one or more of the markets described in the table.Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

-Refer to Table 8-1.Suppose the government is considering levying a tax in one or more of the markets described in the table.Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

A) market A only

B) markets A and C only

C) markets B and D only

D) market C only

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a good is taxed,the burden of the tax

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is more inelastic.

C) falls more heavily on the side of the market that is closer to unit elastic.

D) is distributed independently of relative elasticities of supply and demand.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Essay

Using demand and supply diagrams,show the difference in deadweight loss between (a)a market with inelastic demand and supply and (b)a market with elastic demand and supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-1

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The consumer surplus before the tax is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The consumer surplus before the tax is measured by the area

A) M.

B) L+M+Y.

C) J.

D) J+K+I.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

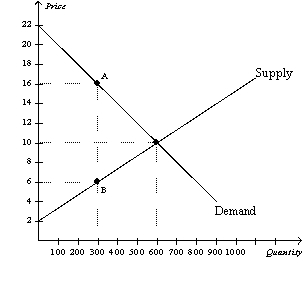

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.The original tax can be represented by the vertical distance AB.Suppose the government is deciding whether to lower the tax to CD or raise it to FG.Which of the following statements is not correct?

-Refer to Figure 8-17.The original tax can be represented by the vertical distance AB.Suppose the government is deciding whether to lower the tax to CD or raise it to FG.Which of the following statements is not correct?

A) Compared to the original tax, the larger tax will increase tax revenue.

B) Compared to the original tax, the smaller tax will decrease deadweight loss.

C) Compared to the original tax, the smaller tax will decrease tax revenue.

D) Compared to the original tax, the larger tax will increase deadweight loss.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on gasoline increases from $2 to $4 per gallon,the deadweight loss from the tax increases by a factor of

A) one-half.

B) two.

C) four.

D) six.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Reducing a high tax rate is less likely to increase tax revenue than is reducing a low tax rate.

B) Reducing a high tax rate is more likely to increase tax revenue than is reducing a low tax rate.

C) Reducing a high tax rate will have the same effect on tax revenue as reducing a low tax rate.

D) Reducing a tax rate can never increase tax revenue.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a good is taxed,the tax revenue collected by the government equals the decrease in the welfare of buyers and sellers caused by the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-2 Tom mows Stephanie's lawn for $25. Tom's opportunity cost of mowing Stephanie's lawn is $20, and Stephanie's willingness to pay Tom to mow her lawn is $28. -Refer to Scenario 8-2.Assume Tom is required to pay a tax of $3 each time he mows a lawn.Which of the following results is most likely?

A) Stephanie now will decide to mow her own lawn, and Tom will decide it is no longer in his interest to mow Stephanie's lawn.

B) Stephanie is willing to pay Tom to mow her lawn, but Tom will decline her offer.

C) Tom is willing to mow Stephanie's lawn, but Stephanie will decide to mow her own lawn.

D) Tom and Stephanie still can engage in a mutually-agreeable trade.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.What happens to consumer surplus when the tax is imposed in this market?

-Refer to Figure 8-6.What happens to consumer surplus when the tax is imposed in this market?

A) Consumer surplus falls by $3,600.

B) Consumer surplus falls by $2,700.

C) Consumer surplus falls by $1,800.

D) Consumer surplus falls by $900.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 424

Related Exams