A) 5

B) 9

C) 10

D) 15

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

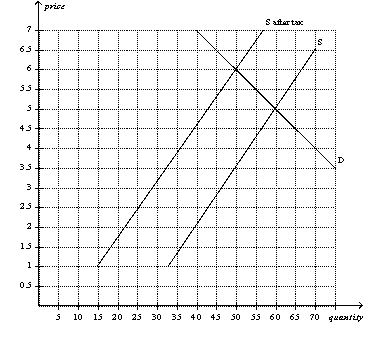

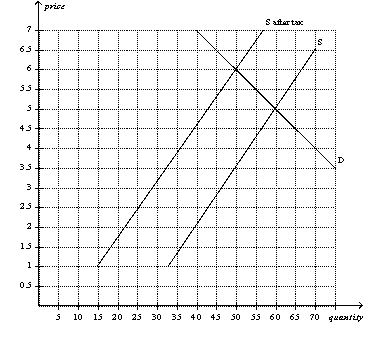

Figure 6-20

-Refer to Figure 6-20.Suppose sellers,rather than buyers,were required to pay this tax (in the same amount per unit as shown in the graph) .Relative to the tax on buyers,the tax on sellers would result in

-Refer to Figure 6-20.Suppose sellers,rather than buyers,were required to pay this tax (in the same amount per unit as shown in the graph) .Relative to the tax on buyers,the tax on sellers would result in

A) buyers bearing the same share of the tax burden.

B) sellers bearing the same share of the tax burden.

C) the same amount of tax revenue for the government.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is a binding constraint on a market,then

A) the equilibrium price must be above the price floor.

B) the quantity demanded must exceed the quantity supplied.

C) sellers cannot sell all they want to sell at the price floor.

D) buyers cannot buy all they want to buy at the price floor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling is binding when it is set

A) above the equilibrium price, causing a shortage.

B) above the equilibrium price, causing a surplus.

C) below the equilibrium price, causing a shortage.

D) below the equilibrium price, causing a surplus.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The United States is the only country in the world with minimum-wage laws.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Discrimination is an example of a rationing mechanism that may naturally develop in response to a binding price floor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

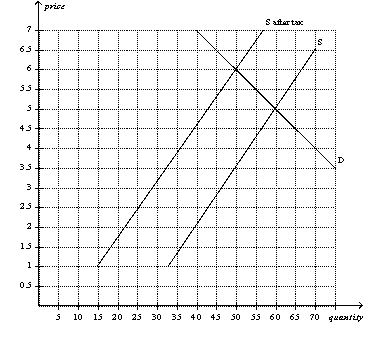

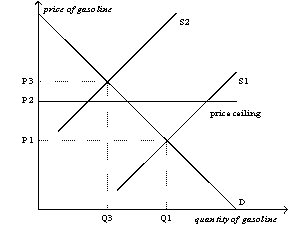

Figure 6-18

-Refer to Figure 6-18.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-18.The price paid by buyers after the tax is imposed is

A) $2.50.

B) $3.50.

C) $5.00.

D) $6.00.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The economy contains many labor markets for different types of workers.

B) The impact of the minimum wage depends on the skill and experience of the worker.

C) The minimum wage is binding for workers with high skills and much experience.

D) The minimum wage is not binding when the equilibrium wage is above the minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-18

-Refer to Figure 6-18.Buyers pay how much of the tax per unit?

-Refer to Figure 6-18.Buyers pay how much of the tax per unit?

A) $1.

B) $1.50.

C) $2.50.

D) $3.50.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling is not binding,then it will have no effect on the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

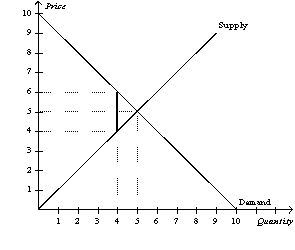

Figure 6-27

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $6.

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer pays $6.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve and the supply curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is imposed on a market with inelastic supply and elastic demand,then

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) it is impossible to determine how the burden of the tax will be shared.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-18

-Refer to Figure 6-18.As the figure is drawn,who sends the tax payment to the government?

-Refer to Figure 6-18.As the figure is drawn,who sends the tax payment to the government?

A) The buyers send the tax payment.

B) The sellers send the tax payment.

C) A portion of the tax payment is sent by the buyers, and the remaining portion is sent by the sellers.

D) The question of who sends the tax payment cannot be determined from the graph.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

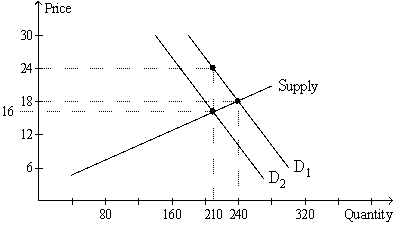

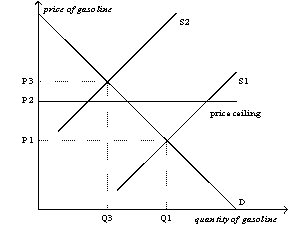

Figure 6-12

-Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S₁ to S₂,

-Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S₁ to S₂,

A) the market price will increase to P3.

B) a surplus will occur at the new market price of P2.

C) the market price will stay at P1.

D) a shortage will occur at the new market price of P2.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium price of a physical examination ("physical") by a doctor is $200,and the government imposes a price ceiling of $150 per physical.As a result of the price ceiling,the

A) demand curve for physicals shifts to the right.

B) supply curve for physicals shifts to the left.

C) quantity demanded of physicals increases, and the quantity supplied of physicals decreases.

D) number of physicals performed stays the same.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 20-cent tax on the sellers of iced tea.Which of the following is not correct? The tax would

A) shift the supply curve upward by 20 cents.

B) raise the equilibrium price by 20 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Sellers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then the

A) demand curve will shift upward by $20, and the effective price received by sellers will increase by $20.

B) demand curve will shift upward by $20, and the effective price received by sellers will increase by less than $20.

C) supply curve will shift downward by $20, and the price paid by buyers will decrease by $20.

D) supply curve will shift downward by $20, and the price paid by buyers will decrease by less than $20.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-12

-Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S₁ to S₂,the resulting quantity of gasoline that is bought and sold is

-Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S₁ to S₂,the resulting quantity of gasoline that is bought and sold is

A) less than Q3.

B) Q3.

C) between Q1 and Q3.

D) at least Q1.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per ticket on buyers of NFL game tickets,then the price paid by buyers of NFL game tickets would

A) increase by less than $5.

B) increase by exactly $5.

C) increase by more than $5.

D) decrease by an indeterminate amount.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 521 - 540 of 557

Related Exams