A) Interest on notes receivable is recorded as revenue only when the cash is received.

B) When a company makes an interest payment on a note,the payment is debited to Interest Receivable.

C) Interest on notes receivable is recognized when it is earned,which is not necessarily when the interest is received in cash.

D) Interest earned but not yet received must be recorded in an adjusting entry which includes a debit to Interest Revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Co.uses the allowance method of determining bad debt expense.It collects $250 from a customer that Adams had previously written-off.As a result of collecting this $250,its:

A) total assets increases by $250.

B) net income increases by $250.

C) total assets remains the same.

D) stockholders' equity increases by $250.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recording the estimate of bad debt expense:

A) increases assets.

B) increases net income.

C) is done at the same time the credit sale is recorded.

D) follows the expense recognition ("matching") principle.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

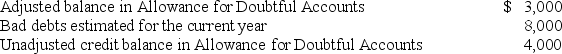

Cachet Co.has the following information:  No recoveries were recorded during the year.What was the amount of accounts written off during the year?

No recoveries were recorded during the year.What was the amount of accounts written off during the year?

A) $15,000

B) $9,000

C) $8,000

D) $4,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts Receivable has a $3,450 balance,and the Allowance for Doubtful Accounts has a $300 credit balance.An $120 account receivable is written-off.Net receivables (net realizable value) after the write-off equals:

A) $3,030.

B) $3,150.

C) $3,270.

D) $3,330.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Allowance for Doubtful Accounts account is a contra-account that offsets:

A) Bad Debt Expense.

B) Cash.

C) Net Income.

D) Accounts Receivable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Net Accounts Receivable

A) The portion of Accounts Receivable that the company expects to collect.

B) The time at which a loan must be repaid.

C) An agreement by a borrower to repay the lending company with interest during a specified time period.

D) The days of the year divided by the net sales revenue.

E) A financial statement that shows the calculation of Bad Debt Expense for a company.

F) Total money owed the company for sales made on credit.

G) An account that is debited for the amount of credit sales estimated as uncollectible.

H) A contra-asset account.

I) The time at which a borrower must make annual interest payments.

J) Net credit sales revenue divided by the average net receivables.

K) Net credit sales revenue divided by the net income.

L) The days of the year divided by the receivables turnover ratio.

N) H) and K)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A subsidiary account is:

A) prohibited by GAAP.

B) a separate account maintained internally for billing purposes.

C) used for tax purposes to enable calculation of taxable income.

D) used only for computing the accounts receivable turnover.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phantom Inc.has an unadjusted debit balance of $5,250 in its Allowance for Doubtful Accounts.The company has experienced bad debt losses of 2% of credit sales in prior periods.Phantom reported net credit sales of $2,250,000 for the current period.To record the potential bad debts,Phantom would debit:

A) Allowance for Doubtful Accounts for $45,000.

B) Allowance for Doubtful Accounts for $50,250.

C) Bad Debt Expense for $50,250.

D) Bad Debt Expense for $45,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry that includes a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable is a(n) :

A) write-off of a specific customer's account.

B) adjusting entry to allow for estimated bad debts.

C) subsidiary entry to increase a customer's account for credit sales.

D) net realizable entry to report the amount expected to be collected.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The receivables turnover ratio gives information on:

A) how many times inventory is turned over per year.

B) how many times the company sells and collects amounts on account per year.

C) how many customers default per year.

D) the profitability of a company.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the balance sheet,the Allowance for Doubtful Accounts:

A) is included in current liabilities.

B) increases the reported Accounts Receivable,Net.

C) is reported under the heading "Other Assets."

D) is subtracted from Accounts Receivable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utopia Corporation provides $6,000 worth of lawn care on account during the month.Experience suggests that about 3% of net credit sales will not be collected.To record the potential bad debts,Utopia Corporation would debit:

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $180.

B) Allowance for Doubtful Accounts and credit Bad Debt Expense for $180.

C) Bad Debt Expense and credit Allowance for Doubtful Accounts for $180.

D) Bad Debt Expense and credit Accounts Receivable for $180.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libby Company uses the percentage of credit sales method for calculating Bad Debt Expense.The company reported $216,000 in total sales during the year;$178,000 of which were on credit.Libby has experienced bad debt losses of 5% of credit sales in prior periods.What is the estimated amount of Bad Debt Expense for the year?

A) $10,800

B) $8,900

C) $38,000

D) $1,900

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A customer of Halifax Manufacturing recently filed for bankruptcy protection two months ago,leading Halifax's credit manager to conclude that the company would never collect the balance of $15,600 owed by the customer. Suppose that three months after filing bankruptcy,Halifax's customer paid its outstanding account balance.Which of the following journal entries would be made to record this transaction?

A) Debit Cash and credit Bad Debt Expense for $15,600.

B) Debit Cash and credit Accounts Receivable for $15,600.

C) Debit Accounts Receivable and credit Allowance for Doubtful Accounts for $15,600;debit Cash and credit Accounts Receivable for $15,600.

D) Debit Cash and credit Sales for $15,600.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Allowance For Doubtful Accounts

A) The portion of Accounts Receivable that the company expects to collect.

B) The time at which a loan must be repaid.

C) An agreement by a borrower to repay the lending company with interest during a specified time period.

D) The days of the year divided by the net sales revenue.

E) A financial statement that shows the calculation of Bad Debt Expense for a company.

F) Total money owed the company for sales made on credit.

G) An account that is debited for the amount of credit sales estimated as uncollectible.

H) A contra-asset account.

I) The time at which a borrower must make annual interest payments.

J) Net credit sales revenue divided by the average net receivables.

K) Net credit sales revenue divided by the net income.

L) The days of the year divided by the receivables turnover ratio.

N) D) and K)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts is a:

A) permanent account so its balance carries forward to the next accounting period.

B) permanent account so its balance is closed (zeroed out) at the end of the accounting period.

C) temporary account so its balance is closed (zeroed out) at the end of the accounting period.

D) temporary account so its balance carries forward to the next accounting period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A customer of Halifax Manufacturing recently filed for bankruptcy protection two months ago,leading Halifax's credit manager to conclude that the company would never collect the balance of $15,600 owed by the customer. Which of the following journal entries would be made by Halifax to record the write-off of the customer's Accounts Receivable balance?

A) Debit Allowance for Doubtful Accounts and credit Accounts Receivable for $15,600.

B) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts for $15,600.

C) Debit Bad Debt Expense and credit Accounts Receivable for $15,600.

D) Debit Sales and credit Accounts Receivable for $15,600.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

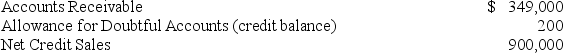

Wrangler Inc.uses the percentage of credit sales method to estimate Bad Debt Expense.At the end of the year,the company's unadjusted trial balance includes the following:  Wrangler has experienced bad debt losses of 0.5% of credit sales in prior periods.What is the Bad Debt Expense to be recorded for the year?

Wrangler has experienced bad debt losses of 0.5% of credit sales in prior periods.What is the Bad Debt Expense to be recorded for the year?

A) $4,500

B) $4,300

C) $4,700

D) $45,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because it is easier to use,the direct write-off method for uncollectible accounts is typically used instead of the allowance method.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 240

Related Exams