B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of repairs to damaged property is not an acceptable measure of the loss in value of the property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2019, Joanne invested $90,000 for a 20% interest in a limited liability company (LLC) in which she is a material participant.The LLC reported losses of $340,000 in 2019 and $180,000 in 2020.Joanne's share of the LLC's losses was $68,000 in 2019 and $36,000 in 2020.How much of these losses can Joanne deduct?

A) $68,000 in 2019; $36,000 in 2020.

B) $68,000 in 2019; $22,000 in 2020.

C) $0 in 2019; $0 in 2020.

D) $68,000 in 2019; $0 in 2020.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

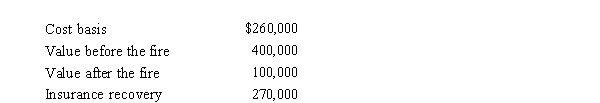

John had adjusted gross income of $60,000 in 2019.During the year, his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident, He was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

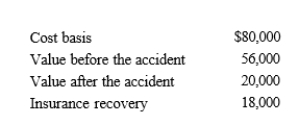

John had an accident with his personal use car.As a result of the accident, He was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:  What is John's itemized casualty loss deduction?

What is John's itemized casualty loss deduction?

A) $0

B) $2,000

C) $17,000

D) $18,000

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year, Ethan performs personal services as follows: 800 hours in his information technology consulting practice, 625 hours in a real estate development business, and 510 hours in a condominium leasing operation.He expects that losses will be realized from the two real estate ventures and that his consulting practice will show a profit.Ethan files a joint return with his spouse whose salary is $125,000.The income and losses from the following ventures are considered active and not subject to the passive activity loss limitations:

A) Only the information technology consulting practice.

B) Only the information technology consulting practice and the real estate development business.

C) Only the information technology consulting practice and the condominium leasing operation.

D) All three of the ventures are considered active and not subject to the passive activity loss limitations.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Joyce, an architect, earns $100,000 from her practice in the current year.In addition, she receives $35,000 in dividends, capital gains, and annuity income during the year.Further, she incurs a loss of $35,000 from an investment in a passive activity.Joyce's AGI for the year after considering the passive investment is $100,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

From January through November, Vern participated for 420 hours as a salesman in a partnership in which he owns a 50% interest.The partnership has four full-time employees.During December, Vern spends 110 hours cleaning the store and painting the walls in order to meet the material participation standards.Vern qualifies as a material participant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When determining whether an individual is a material participant, participation by an owner's spouse generally counts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wes's at-risk amount in a passive activity is $25,000 at the beginning of the current year.His current loss from the activity is $35,000 and he has no passive activity income.At the end of the current year, which of the following statements is incorrect?

A) Wes has a loss of $25,000 suspended under the passive activity loss rules.

B) Wes has an at-risk amount in the activity of $0.

C) Wes has a loss of $10,000 suspended under the at-risk rules.

D) Wes has a loss of $35,000 suspended under the passive activity loss rules.

E) None of these is incorrect.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Mary Jane participates for 100 hours during the year in an activity she owns.She has no employees and is the only participant in the activity.The activity is a significant participation activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining whether a debt is a business or nonbusiness bad debt, the debtor's use of the borrowed funds is important.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Jackson Company incurs a $50,000 loss on a passive activity during the year.The company has active income of $34,000 and portfolio income of $24,000.If Jackson is a personal service corporation, it may deduct $34,000 of the passive activity loss.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Rita earns a salary of $150,000, and invests $40,000 for a 20% interest in a passive activity.Operations of the activity result in a loss of $250,000, of which Rita's share is $50,000.How is her loss characterized?

A) $40,000 is suspended under the passive activity loss rules and $10,000 is suspended under the at-risk rules.

B) $40,000 is suspended under the at-risk rules and $10,000 is suspended under the passive activity loss rules.

C) $50,000 is suspended under the passive activity loss rules.

D) $50,000 is suspended under the at-risk rules.

E) None of these characterizes it.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lew owns five activities, and he elects not to group them together as a single activity under the "appropriate economic unit" standard.During the year, he participates for 120 hours in Activity A, 150 hours in Activity B, 140 hours in Activity C, 110 hours in Activity D, and 100 hours in Activity E.Which of the following statements is correct?

A) Activities A, B, C, D, and E are all significant participation activities.

B) Lew is a material participant in Activities A, B, C, and D only.

C) Lew is a material participant in Activities A, B, C, D, and E.

D) None of these.

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

True/False

Several years ago, John purchased 2,000 shares of Red Corporation's § 1244 stock from Mark for $40,000.Last year, John sold one-half of his Red Corporation stock to Mike for $12,000.During the current year, John sold the remaining Red Corporation stock for $3,000.John has a $17,000 ($3,000 - $20,000) ordinary loss for the current year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a nonbusiness casualty loss is spread between two taxable years, the loss in the second year is reduced by 10% of adjusted gross income for the first year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A business bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer can carry back any NOL incurred for two years and then forward up to 20 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandra acquired a passive activity three years ago.Until last year, the activity was profitable and her at-risk amount was $300,000.Last year, the activity produced a loss of $100,000, and in the current year, the loss is $50,000.Assuming Sandra has received no passive activity income in the current or prior years, her suspended passive activity loss from the activity is:

A) $90,000 from last year and $50,000 from the current year.

B) $100,000 from last year and $50,000 from the current year.

C) $0 from last year and $0 from the current year.

D) $50,000 from the current year.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nell sells a passive activity with an adjusted basis of $45,000 for $105,000.Suspended losses attributable to this property total $45,000.The total gain and the taxable gain are:

A) $60,000 total gain; $105,000 taxable gain.

B) $10,000 total gain; $15,000 taxable gain.

C) $60,000 total gain; $0 taxable gain.

D) $60,000 total gain; $15,000 taxable gain.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 147

Related Exams