B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the recognized gain on an involuntary conversion equals the realized gain because of a reinvestment deficiency, the basis of the replacement property will be more than its cost (cost plus realized gain).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis for depreciation on depreciable gift property received is the donor's adjusted basis of the property at the date of the gift (assuming no gift taxes are paid).The rule applies regardless of whether the fair market value at the date of the gift is greater than or less than the donor's adjusted basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor inherited 100 acres of land on the death of his father in 2019.A Federal estate tax return was filed and this land was valued therein at $650,000, its fair market value at the date of the father's death.The father had originally acquired the land in 1973 for $112,000 and prior to his death, he had expended $20,000 on permanent improvements.Determine Taylor's holding period for the land.

A) Will begin with the date his father acquired the property.

B) Will automatically be long term.

C) Will begin with the date of his father's death.

D) Will begin with the date the property is distributed to him.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelly inherits land that had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2019, the date of the decedent's death.The executor distributes the land to Kelly on November 12, 2019, at which time the fair market value is $49,000.The fair market value on February 4, 2020, is $45,000.In filing the estate tax return, the executor elects the alternate valuation date.Kelly sells the land on June 10, 2020, for $48,000.What is her recognized gain or loss?

A) ($1,000)

B) ($2,000)

C) ($47,000)

D) $1,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Wade is a salesman for a real estate development company.Because he is the "salesperson of the year," he is permitted to purchase a lot from the developer for $90,000.The fair market value of the lot is $150,000 and the developer's adjusted basis is $100,000.Wade must recognize a gain of $10,000 ($100,000 developer's adjusted basis - $90,000 cost to Wade), and his adjusted basis for the lot is $100,000 ($90,000 cost + $10,000 recognized gain).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Parker bought a brand new Ferrari on January 1, 2019, for $125,000.Parker was fatally injured in an auto accident on June 23, 2019, when the fair market value of the car was $105,000.Parker was driving a loaner car from the Ferrari dealership while his car was being serviced.In his will, Parker left the Ferrari to his best friend, Ryan.Ryan's holding period for the Ferrari begins on January 1, 2019.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If losses are disallowed in a related-party transaction, the holding period for the buyer includes the holding period of the seller.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

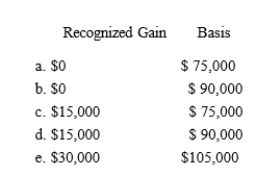

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer

verified

Correct Answer

verified

True/False

An involuntary conversion results from the destruction (complete or partial), theft, seizure, requisition or condemnation, or the sale or exchange under threat or imminence of requisition or condemnation of the taxpayer's property.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A building located in Virginia (used in business) exchanged for a building located in France (used in business) cannot qualify for like-kind exchange treatment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis for gain and loss of personal use property converted to business use is the lower of the adjusted basis or the fair market value on the date of conversion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul sells property with an adjusted basis of $45,000 to his daughter Dean for $38,000.Dean subsequently sells the property to her brother, Preston, for $38,000.Three years later, Preston sells the property to Hun, an unrelated party, for $50,000.What is Preston's recognized gain or loss on the sale of the property to Hun?

A) $0

B) $5,000

C) $12,000

D) ($5,000)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Gene purchased for $45,000 an SUV that he uses 100% for personal purposes.When the SUV is worth $30,000, he contributes it to his business.The gain basis is $45,000, the loss basis is $30,000, and the basis for cost recovery is $45,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bria's office building (basis of $225,000 and fair market value $275,000) is destroyed by a hurricane.Due to a 30% co-insurance clause, Bria receives insurance proceeds of $192,500 two months after the date of the loss.One month later, Bria uses the insurance proceeds to purchase a new office building for $275,000.Her adjusted basis for the new building is $307,500 ($275,000 cost + $32,500 postponed loss).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In computing the amount realized when the fair market value of the property received cannot be determined, the fair market value of the property surrendered may be used.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Reggie owns all the stock of Amethyst, Inc.(adjusted basis of $100,000).If he receives a distribution from Amethyst of $90,000 and corporate earnings and profits are $15,000, Reggie has a capital gain of $5,000 and an adjusted basis for his Amethyst stock of $0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The fair market value of property received in a sale or other disposition is the price at which property will change hands between a willing seller and a willing buyer when neither is compelled to sell or buy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Terry exchanges real estate (acquired on August 25, 2013) held for investment for other real estate to be held for investment on September 1, 2019.None of the realized gain of $10,000 is recognized, and Terry's adjusted basis for the new real estate is a carryover basis of $80,000.Consequently, Terry's holding period for the new real estate begins on August 25, 2013.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arthur owns a tract of undeveloped land (adjusted basis of $145,000) that he sells to his son, Ned, for its fair market value of $105,000.What is Arthur's recognized gain or loss and Ned's basis in the land?

A) $0 and $105,000.

B) $0 and $145,000.

C) ($40,000) and $105,000.

D) ($40,000) and $145,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 126

Related Exams