B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the Federal income tax formula for individuals, the determination of adjusted gross income (AGI) precedes that of taxable income (TI).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Adjusted gross income (AGI) appears on page 2 of Form 1040.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Evan and Eileen Carter are husband and wife and file a joint return for 2019.Both are under 65 years of age.They provide more than half of the support of their daughter, Pamela (age 25) , who is a full-time medical student.Pamela receives a $5,000 scholarship covering her tuition at college.Evan and Eileen furnish all of the support of Belinda (Evan's grandmother) , who is age 80 and lives in a nursing home.They also support Peggy (age 66) , who is a friend of the family and lives with them.How many dependents may the Carters claim?

A) None

B) One

C) Two

D) Three

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Kim, a resident of Oregon, supports his parents who are residents of Canada but citizens of Korea.Kim can claim a dependent tax credit for his parents.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Matching Regarding classification as a dependent, classify each statement in one of the four categories: a. Could be a qualifying child. b. Could be a qualifying relative. c. Could be either a qualifying child or a qualifying relative. d. Could be neither a qualifying child nor a qualifying relative. -A daughter who does not live with taxpayer.

Correct Answer

verified

Correct Answer

verified

True/False

Claude's deductions from AGI exceed the standard deduction allowed for the current year.Under these circumstances, Claude cannot claim the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Match the statements that relate to each other.Note: Choice k.may be used more than once. a.Available to a 70-year-old father claimed as a dependent by his son. b.Equal to tax liability divided by taxable income. c.The highest income tax rate applicable to a taxpayer. d.Not eligible for the standard deduction. e.No one qualified taxpayer meets the support test. f.Taxpayer's ex-husband does not qualify. g.A dependent child (age 18) who has only unearned income. h.Highest applicable rate is 37%. i.Applicable rate could be as low as 0%. j.Maximum rate is 28%. k.No correct match provided. -Long-term capital gains

Correct Answer

verified

Correct Answer

verified

True/False

Since an abandoned spouse is treated as not married and has one or more dependent children, he or she qualifies for the standard deduction available to head of household.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A child who is married cannot be subject to the kiddie tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tony, age 15, is claimed as a dependent by his grandmother.During 2019, he had interest income from Boeing Corporation bonds of $1,000 and earnings from a part-time job of $800.Tony's taxable income is:

A) $1,800.

B) $1,800 - $800 - $1,100 = ($100) .

C) $1,800 - $1,150 = $650.

D) $1,800 - $1,100 = $700.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

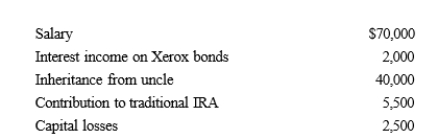

During 2019, Enrique had the following transactions:  Enrique's AGI is:

Enrique's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kyle, whose wife died in December 2016, filed a joint tax return for 2016.He did not remarry but has continued to maintain his home in which his two dependent children live.What is Kyle's filing status in 2019?

A) Head of household

B) Surviving spouse

C) Single

D) Married filing separately

E) None of these

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which the following, if any, of is a correct statement relating to the kiddie tax in 2019?

A) If the parents are divorced, the income of the noncustodial parent is used to determine the allocable parental tax.

B) The components for the application of the kiddie tax are not subject to adjustment for inflation.

C) If the kiddie tax applies, the parents must include the income of the child on their own income tax return.

D) The kiddie tax does not apply if both parents of the child are deceased.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In terms of the tax formula applicable to individual taxpayers, which of the following statements, if any, is correct?

A) In arriving at taxable income, a taxpayer must choose between the standard deduction and itemized deductions.

B) In arriving at AGI, personal and dependency exemptions are subtracted from gross income.

C) In arriving at taxable income, a taxpayer must choose between the standard deduction and the deduction for qualified business income.

D) The tax formula does not apply if a taxpayer elects to claim the standard deduction.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under the income tax formula, a taxpayer must choose between deductions for AGI and the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in a taxpayer's AGI could increase the amount of medical expenses that can be deducted.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Matching Regarding classification as a dependent, classify each statement in one of the four categories: a. Could be a qualifying child. b. Could be a qualifying relative. c. Could be either a qualifying child or a qualifying relative. d. Could be neither a qualifying child nor a qualifying relative. -A stepdaughter who does not live with taxpayer.

Correct Answer

verified

Correct Answer

verified

Essay

Matching Regarding classification as a dependent, classify each statement in one of the four categories: a. Could be a qualifying child. b. Could be a qualifying relative. c. Could be either a qualifying child or a qualifying relative. d. Could be neither a qualifying child nor a qualifying relative. -A family friend who is supported by and lives with the taxpayer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harpreet, whose husband died in December 2018, maintains a household in which her dependent mother lives. Which (if any) of the following is her filing status for the tax year 2019? (Note: Harpreet is the executor of her husband's estate.)

A) Single

B) Married, filing separately

C) Surviving spouse

D) Head of household

E) Married, filing jointly

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 132

Related Exams