B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barney is a full-time graduate student at State University.He serves as a teaching assistant for which he is paid $700 per month for nine months and his $5,000 tuition is waived.The university waives tuition for all of its employees.In addition, Barney receives a $1,500 research grant to pursue his own research and studies.Barney's gross income from the above is:

A) $0.

B) $6,300.

C) $11,300.

D) $12,800.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer pays points to obtain financing to purchase a second residence.At the election of the taxpayer, the points can be deducted as interest expense for the year paid.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Expenses that are reimbursed by a taxpayer's employer under a dependent care assistance program also can qualify for the credit for child and dependent care expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On the recommendation of a physician, Ed has a swimming pool installed at his residence because of a heart condition.If he is allowed to deduct all or part of the cost of the pool, Ed's increase in utility bills due to the operation of the pool qualifies as a medical expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kevin and Shuang have two children, ages 8 and 14.They spend $6,200 per year on eligible employment related expenses for the care of their children after school.Kevin earned a salary of $20,000 and Shuang earned a salary of $18,000.What is the amount of the couple's credit for child and dependent care expenses?

A) $690

B) $713

C) $1,380

D) $1,426

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Personal expenditures that are deductible as itemized deductions include medical expenses, Federal income taxes, state income taxes, property taxes on a personal residence, mortgage interest, and charitable contributions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

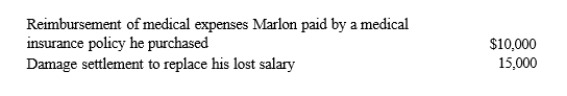

Early in the year, Marlon was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained, he received the following payments during the year:  What is the amount that Marlon must include in gross income for the current year?

What is the amount that Marlon must include in gross income for the current year?

A) $25,000.

B) $15,000.

C) $12,500.

D) $10,000.

E) $0.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

John told his nephew, Steve, "if you maintain my house when I cannot, I will leave the house to you when I die." Steve maintained the house and when John died, Steve inherited the house.The value of the residence can be excluded from Steve's gross income as an inheritance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Byron owned stock in Blossom Corporation that he donated to a museum (a qualified charitable organization) on June 8 this year.What is the amount of Byron's deduction assuming that he had purchased the stock for $10,500 last year on August 7, and the stock had a fair market value of $13,800 when he made the donation?

A) $3,300

B) $10,500

C) $12,150

D) $13,800

E) None of these

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Ashley received a scholarship to be used as follows: tuition, $6,000; room and board, $9,000; and books and laboratory supplies, $2,000.Ashley is required to include only $9,000 in her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This year, Carol, a single taxpayer, purchased a vacation home for $400,000 using a home equity loan of $350,000 on her principal residence.She has no other debt on her principal residence.Carol paid $16,000 of interest on the debt this year.How much of this interest is deductible assuming that Carol itemizes her deductions?

A) $0

B) $10,000

C) $16,000

D) $125,000

E) None of these

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The earned income credit, a form of a negative income tax, is a refundable credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a requirement for an alimony deduction?

A) The payments must be in cash.

B) The payments must cease upon the death of the payee.

C) The payments must extend over at least three years.

D) The payor and payee must not live in the same household at the time of the payments.

E) All of these are requirements for an alimony deduction.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The tax benefits resulting from tax credits and tax deductions are affected by the tax rate bracket of the taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Georgia contributed $2,000 to a qualifying Health Savings Account in the current year.The entire amount qualifies as an expense deductible for AGI.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

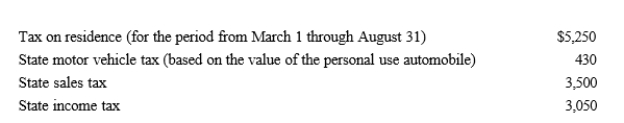

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of these

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Charitable contributions that exceed the percentage limitations for the current year can be carried over for up to three years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thelma and Mitch were divorced in 2018.The couple had a joint brokerage account that included stocks with a basis of $600,000 and a fair market value of $1,000,000.Under the terms of the divorce agreement, Mitch would receive the stocks and Mitch would pay Thelma $100,000 each year for six years, or until Thelma's death, whichever should occur first.Thelma and Mitch lived apart when the payments were made by Mitch.He paid the $600,000 to Thelma over the six-year period.The divorce agreement did not contain the word "alimony." Then, Mitch sold the stocks for $1,300,000.Mitch's recognized gain from the sale is:

A) $-0-.

B) $1,000,000 ($1,300,000 - $300,000) .

C) $700,000 ($1,300,000 - $600,000) .

D) $300,000 ($1,300,000 - $1,000,000) .

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ahmad is considering making a $10,000 investment in a venture whose promoter promises will generate immediate tax benefits for him.Ahmad, who normally itemizes his deductions, is in the 32% marginal tax bracket.If the investment is of a type where the taxpayer may claim either a tax credit of 25% of the amount of the expenditure or an itemized deduction for the amount of the investment, what treatment is likely most beneficial to Ahmad, and by how much will Ahmad's tax liability decline because of the investment?

A) $-0-, take neither the itemized deduction nor the tax credit.

B) $2,500, take the tax credit.

C) $3,200, take the itemized deduction.

D) Both options produce the same benefit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 129

Related Exams