B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Juanita owns 60% of the stock in a C corporation that had a profit of $200,000 in the current year.Carlos owns a 60% interest in a partnership that had a profit of $200,000 during the year.The corporation distributed $45,000 to Juanita, and the partnership distributed $45,000 to Carlos.With respect to this information, which of the following statements is incorrect?

A) Juanita must report $120,000 of income from the corporation.

B) The corporation must pay corporate tax on $200,000 of income.

C) Carlos must report $120,000 of income from the partnership.

D) The partnership is not subject to a Federal entity-level income tax.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Employment taxes apply to all entity forms of operating a business.As a result, employment taxes are a neutral factor in selecting the most tax effective form of operating a business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

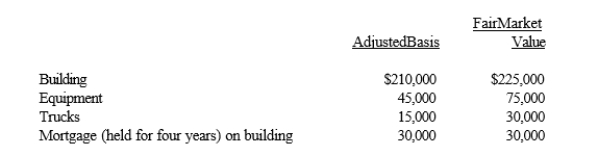

Rick transferred the following assets and liabilities to Warbler Corporation.  In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three individuals form Skylark Corporation with the following contributions: Cliff, cash of $50,000 for 50 shares; Brad, land worth $20,000 (basis of $11,000) for 20 shares; and Ron, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares.

A) These transfers are fully taxable and not subject to § 351.

B) Ron's basis in his stock is $27,000.

C) Ron's basis in his stock is $6,000.

D) Brad's basis in his stock is $20,000.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In a § 351 transaction, if a transferor receives consideration other than stock, the transaction can be taxable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because of the taxable income limitation, no dividends received deduction is allowed if a corporation has an NOL for the current taxable year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To help avoid the thin capitalization problem, it is advisable to make the repayment of the debt contingent upon the corporation's earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation is thinly capitalized, all debt is reclassified as equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bjorn owns a 60% interest in an S corporation that earned $150,000 in the current year.He also owns 60% of the stock in a C corporation that earned $150,000 during the year.The S corporation distributed $30,000 to Bjorn and the C corporation paid dividends of $30,000 to Bjorn.How much income must Bjorn report from these businesses?

A) $0 income from the S corporation and $30,000 income from the C corporation.

B) $30,000 income from the S corporation and $30,000 of dividend income from the C corporation.

C) $90,000 income from the S corporation and $0 income from the C corporation.

D) $90,000 income from the S corporation and $30,000 income from the C corporation.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Ruth transfers property worth $200,000 (basis of $60,000) to Goldfinch Corporation.In return, she receives 80% of its stock (worth $180,000) and a long-term note executed by Goldfinch and made payable to Ruth (worth $20,000).Ruth will recognize no gain on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

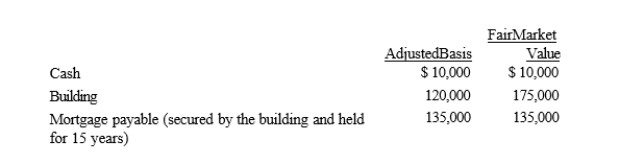

Dick, a cash basis taxpayer, incorporates his sole proprietorship.He transfers the following items to newly created Orange Corporation.  With respect to this transaction:

With respect to this transaction:

A) Orange Corporation's basis in the building is $120,000.

B) Dick has no recognized gain.

C) Dick has a recognized gain of $5,000.

D) Dick has a recognized gain of $10,000.

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Basis of appreciated property transferred minus boot received (including liabilities transferred) plus gain recognized equals basis of stock received in a § 351 transfer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Seoyun and Nicole form Indigo Corporation with the following transfers: inventory from Seoyun (basis of $360,000 and fair market value of $400,000) and improved real estate from Nicole (basis of $320,000 and fair market value of $375,000) .Nicole, an accountant, agrees to contribute her services (worth $25,000) in organizing Indigo.The corporation's stock is distributed equally to Seoyun and Nicole.As a result of these transfers:

A) Indigo can deduct $25,000 as a business expense.

B) Nicole has a recognized gain of $55,000 on the transfer of the real estate.

C) Indigo has a basis of $360,000 in the inventory.

D) Indigo has a basis of $375,000 in the real estate.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a transaction qualifies under § 351, any recognized gain is equal to the value of the boot received.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For § 351 purposes, stock rights and stock warrants are included in the definition of "stock."

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The control requirement under § 351 requires that the person or persons transferring property to the corporation immediately after the transfer own stock possessing at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock of the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To induce Yellow Corporation to build a new manufacturing facility in Knoxville, Tennessee, the city donates land (fair market value of $400,000) and cash of $100,000 to the corporation.Several months after the donation, Yellow Corporation spends $450,000 (which includes the $100,000 received from Knoxville) on the construction of a new plant located on the donated land.

A) Yellow recognizes income of $100,000 as to the donation.

B) Yellow has a zero basis in the land and a basis of $450,000 in the plant.

C) Yellow recognizes income of $500,000 as to the donation.

D) Yellow has a zero basis in the land and a basis of $350,000 in the plant.

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George transfers cash of $150,000 to Finch Corporation, a newly formed corporation, for 100% of the stock in Finch worth $80,000 and debt in the amount of $70,000, payable in equal annual installments of $7,000 plus interest at the rate of 9% per annum.In the first year of operation, Finch has net taxable income of $40,000.If Finch pays George interest of $6,300 and $7,000 principal payment on the note:

A) George has dividend income of $13,300.

B) Finch Corporation does not have a tax deduction with respect to the payment.

C) George has dividend income of $7,000.

D) Finch Corporation has an interest expense deduction of $6,300.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elk, a C corporation, has $370,000 operating income and $290,000 operating expenses during the current year.In addition, Elk has a $10,000 long-term capital gain and a $17,000 short-term capital loss.Elk's taxable income is:

A) $63,000.

B) $73,000.

C) $80,000.

D) $90,000.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 136

Related Exams