A) $5

B) $60

C) $25

D) $24

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury Stock is listed in the stockholders' equity section on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If common stock is issued for an amount greater than par value, the excess should be credited to

A) Retained Earnings

B) Cash

C) Legal Capital

D) Paid-In Capital in Excess of Par

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

For the current year ended, ABC had the following transactions: - Issued 10,000 shares of $2.00 par value common stock for $12.00 per share.- Issued 3,000 shares of $50 par value 6% preferred stock for $70 per share.- Purchased 1,000 shares of previously issued common stock for $15.00 per share.- Reported net income of $200,000.- Declared and paid a total dividend of $40,000. Assume that retained earnings had a beginning balance of $75,000.The company does not have any stock outstanding as of the beginning of the current year. a.Treasury stock b.Retained earnings c.Preferred stock d.Excess of issue price over par (preferred)e.Common stock f.Total paid-in capital g.Excess of issue price over par (common)h.Total stockholders' equity -$60,000

Correct Answer

verified

Correct Answer

verified

True/False

The cost method of accounting for the purchase and sale of treasury stock is a commonly used method.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On April 10, Maranda Corporation issued for cash 11,000 shares of no-par common stock at $25. On May 5, Maranda issued at par 1,000 shares of 4%, $50 par preferred stock for cash. On May 25, Maranda issued for cash 15,000 shares of 4%, $50 par preferred stock at $55. Journalize the entries to record the April 10, May 5, and May 25 transactions.

Correct Answer

verified

Correct Answer

verified

True/False

The stock dividends distributable account is listed in the current liability section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 45,000 shares were originally issued and 5,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared?

A) $80,000

B) $10,000

C) $90,000

D) $100,00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A prior period adjustment should be reported as an adjustment to the retained earnings balance at the beginning of the period in which the adjustment was made.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

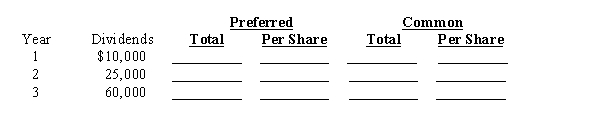

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per-share dividends for each class of stock for each year by completing the schedule.

Correct Answer

verified

Correct Answer

verified

Essay

Macy Company has 10,000 shares of 2% cumulative preferred stock of $50 par and 25,000 shares of $75 par common stock. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

True/False

If a company has preferred stock, the preferred stock dividend is added to net income when computing earnings per common share.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The following account balances appear on the balance sheet of Osgood Industries: Common Stock (300,000 shares authorized, $100 par): $10,000,000 Paid-In Capital in Excess of Par-Common Stock: $2,000,000 Retained Earnings: $45,000,000 The board of directors declared a 2% stock dividend when the market price of the stock was $135 a share. Required: (1)Journalize the entries to record (a)the declaration of the dividend, capitalizing an amount equal to market value (b)the issuance of the stock certificates (2)Determine the following amounts before the stock dividend was declared: (a)Total paid-in capital (b)Total retained earnings (c)Total stockholders' equity (3)Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (a)Total paid-in capital (b)Total retained earnings (c)Total stockholders' equity

Correct Answer

verified

Correct Answer

verified

True/False

The amount of a corporation's retained earnings that has been restricted/appropriated should be reported in the notes to the financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which section of the financial statements would Paid-In Capital from Sale of Treasury Stock be reported?

A) other expense on income statement

B) intangible asset on the balance sheet

C) stockholders' equity on balance sheet

D) other income on income statement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the cost method, when treasury stock is purchased by the corporation, the par value and the price at which the stock was originally issued are important.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On May 10, a company issued for cash 1,500 shares of no-par common stock (with a stated value of $2) at $14, and on May 15, it issued for cash 2,000 shares of $15 par preferred stock at $58. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 12,000 shares of $20 par stock outstanding that has a current market value of $150. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately $50.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following stockholders' equity concepts to the appropriate term (a-h). -Creditors cannot pursue stockholders' personal assets to satisfy claims A)articles of incorporation B)limited liability C)bylaws D)corporation E)public corporation F)board of directors G)private corporation H)dividends

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning taxation is accurate?

A) Corporations pay federal income taxes but not state income taxes.

B) Corporations pay federal, and often state, income taxes.

C) Only the owners must pay taxes on corporate income.

D) Corporations pay income taxes but their owners do not.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 221

Related Exams