A) Cash and stocks

B) Cash but not stocks

C) Stocks but not cash

D) Neither cash nor stocks

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 4 percent, then the money multiplier is

A) 0.04.

B) 25.

C) 2.5.

D) 4.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Federal Reserve governors are given long terms to insulate them from politics.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Money is the only asset that functions as a store of value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When you list prices for necklaces sold on your website, www.sparklingjewels.com, in dollars, this best illustrates money's function as

A) a store of value.

B) a medium of exchange.

C) a unit of account.

D) a method of barter.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 29-1 The Monetary Policy of Tazi is controlled by the country's central bank known as the Bank of Tazi. The local unit of currency is the Tazian dollar. Aggregate banking statistics show that collectively the banks of Tazi hold $375 million of required reserves, $225 million of excess reserves, have issued $7,500 million of deposits, and hold $750 million of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all money is on deposit at the bank. -Which of the following will help to prevent bank runs?

A) A 0% reserve requirement

B) 100% reserve banking

C) Lack of government insurance of deposits

D) Fractional reserve banking

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists is included in what economists call "money"?

A) Cash

B) Cash and stocks and bonds

C) Cash and stocks and bonds and real estate

D) Cash and stocks and bonds and real estate and all other assets

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The money supply of Granov is $10,000 in a 100-percent-reserve banking system. If the Central Bank of Granov decreases the reserve requirement ratio to 10 percent, the money supply could increase by no more than $9,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Demand deposits are balances in bank accounts that depositors can access by writing a check or using a debit card.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the Fed buys bonds in the open market, the money supply decreases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks decide to hold more excess reserves relative to deposits. Other things the same, this action will cause the money supply to

A) fall.To reduce the impact of this the Fed could sell Treasury bonds.

B) fall.To reduce the impact of this the Fed could buy Treasury bonds.

C) rise.To reduce the impact of this the Fed could sell Treasury bonds.

D) rise.To reduce the impact of this the Fed could buy Treasury bonds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 29-3 -Refer to Table 29-3. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional $60,000 into his account at the bank. If the bank takes no other action it will

A) have $64,000 in excess reserves.

B) have $4,000 in excess reserves.

C) be in a position to make new loans equal to a maximum of $6,000.

D) be unable to make any new loans.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve

A) is part of the executive branch of government.

B) is only responsible for controlling the money supply.

C) is the central bank of Canada.

D) was created in 1913.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under a 100-percent-reserve banking system, banks do not influence the supply of money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

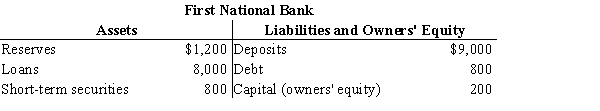

Table 29-5

-Refer to Table 29-5. This bank's leverage ratio is

-Refer to Table 29-5. This bank's leverage ratio is

A) 2.

B) 50.

C) 13.3.

D) 7.5.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, if banks decide to hold a smaller part of their deposits as excess reserves, the money supply will fall.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank has an 8 percent reserve requirement, $10,000 in deposits, and has loaned out all it can, given the reserve requirement.

A) It has $80 in reserves and $9,920 in loans.

B) It has $800 in reserves and $9,200 in loans.

C) It has $1,250 in reserves and $8,750 in loans.

D) It has $8,000 in reserves and $2,000 in loans.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because of the multiple tools at its disposal, the Fed can control the money supply very precisely.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Assume that when $100 of new reserves enter the banking system, the money supply ultimately increases by $800. Assume also that no banks hold excess reserves and that the entire money supply consists of bank deposits. If, at a point in time, reserves for all banks amount to $750, then at that same point in time, loans for all banks amount to $6,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gary's wealth is $1 million. Economists would say that Gary has $1 million worth of money.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 210

Related Exams