Correct Answer

verified

Correct Answer

verified

Essay

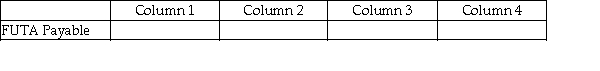

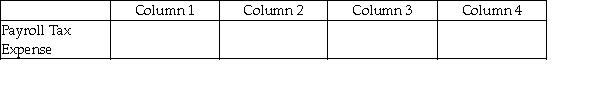

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which form is used to report FICA taxes for the employer and employee, and also federal income taxes for the employee?

A) Form 941

B) Form 944

C) Form 940

D) Form W-2

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

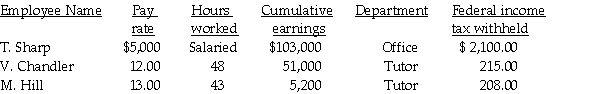

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total deductions for the employees' paychecks.

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total deductions for the employees' paychecks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of an account is Wages and Salaries Payable?

A) Asset

B) Liability

C) Contra-liability

D) Expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wages and Salaries Expense is:

A) equal to net pay.

B) equal to gross pay.

C) equal to the employer's taxes.

D) equal to wages and salaries paid in cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Payroll information for Kinzer's Interior Decorating for the first week in October is as follows:  Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Assume the following tax rates:

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Assume the following tax rates:  Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Correct Answer

verified

Correct Answer

verified

Short Answer

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total retirement.

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total retirement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wages and Salaries Expense account would be used to record:

A) net earnings for the office workers.

B) the amount for payroll tax.

C) gross earnings for the office workers.

D) a debit for the amount of net pay owed to the office workers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

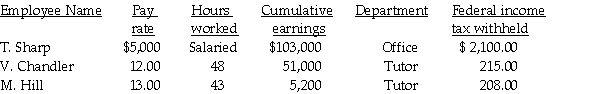

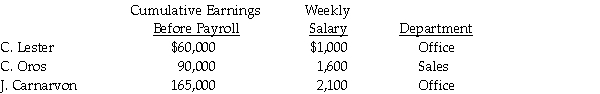

Jefferson Tutoring had the following payroll information on February 28:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

A) a debit to Payroll Tax Expense in the amount of $429.55.

B) a credit to FUTA Payable for $20.00.

C) a credit to SUTA Payable for $50.00.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Both employer and employee contribute to FICA-OASDI and SUTA tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The form used for the annual federal unemployment taxes is Form 941.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A monthly depositor:

A) is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day) .

B) is determined by the amount of Form 941 taxes that they paid in the look-back-period.

C) will remain a monthly depositor, once classified, for one year at which time they will be reevaluated.

D) All of the above answers are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The same deposit rules apply to employers based on the amount collected and owed by that employer for payroll taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There is no limit on the amount of taxes paid for SUTA.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the employees' FICA-OASDI.

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the employees' FICA-OASDI.

Correct Answer

verified

Correct Answer

verified

Essay

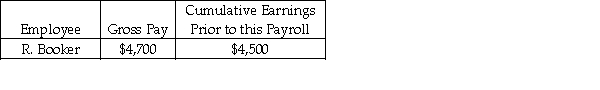

Using the information below, determine the amount of the payroll tax expense for B. Hope Company's first payroll of the year. In your answer list the amounts for FICA (OASDI and Medicare), SUTA, and FUTA.  Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 5.0% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 5.0% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:  Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Federal income tax is 15% of gross pay.

c) Each employee pays $20 per week for medical insurance.

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Federal income tax is 15% of gross pay.

c) Each employee pays $20 per week for medical insurance.

Correct Answer

verified

Correct Answer

verified

True/False

The W-3 is also known as the Transmittal of Wage and Tax Statements.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 113

Related Exams