A) save his earnings to use when he is middle-aged.

B) lend money to a friend to purchase a new car.

C) borrow money to pay for college, which he will later repay when his income rises.

D) attempt to pay for college from his current earnings.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S. data for 2011, the poverty rate is the highest for which group of people?

A) children

B) married couples

C) female-headed households, no spouse present

D) the elderly

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur when the government enacts policies to make the distribution of income more equal?

A) a more efficient allocation of resources

B) a distortion of incentives

C) unchanged behavior

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In 2011 the top 5 percent of income earners accounted for over 50% of all income received by United States' families.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Supplemental Security Income (SSI) program focuses on the poor who are sick or disabled.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A typical worker's normal or average income is called

A) the life cycle.

B) permanent income.

C) transitory income.

D) in-kind transfers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has more income inequality than Japan, Germany, and France.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the doctrine of liberalism, principles of justice are the result of

A) fair agreement and bargain.

B) command-and-control policies.

C) domination of the powerful by the weak.

D) workers owning the factors of production.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

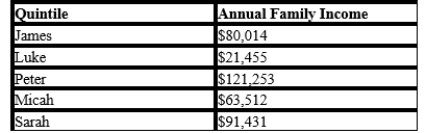

Table 20-14

James, Luke, Peter, Micah, and Sarah are the only five inhabits of Marketsville. The following table shows their income.

-Refer to Table 20-14. According to the table, what percentage of individuals in Marketsville have an income above $90,000?

-Refer to Table 20-14. According to the table, what percentage of individuals in Marketsville have an income above $90,000?

A) 40 percent.

B) 60 percent.

C) 80 percent.

D) 100 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Table 20-14

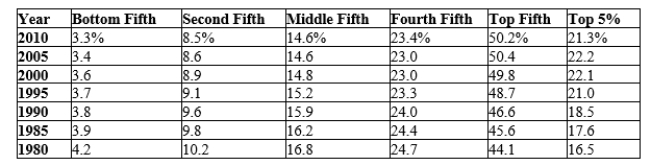

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-14. In 2010, how many more percentage points of total income did the top fifth of the population earn compared to if the income distribution were completely equal?

Source: US Census Bureau

-Refer to Table 20-14. In 2010, how many more percentage points of total income did the top fifth of the population earn compared to if the income distribution were completely equal?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

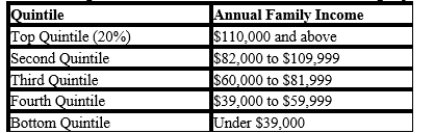

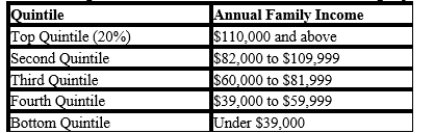

Table 20-13

The following table shows the distribution of income in Widgetapolis.

-Refer to Table 20-13. If the poverty line were $19,915, what would be the poverty rate?

-Refer to Table 20-13. If the poverty line were $19,915, what would be the poverty rate?

A) less than 20%

B) between 20% and 40%

C) between 40% and 60%

D) between 60% and 80%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

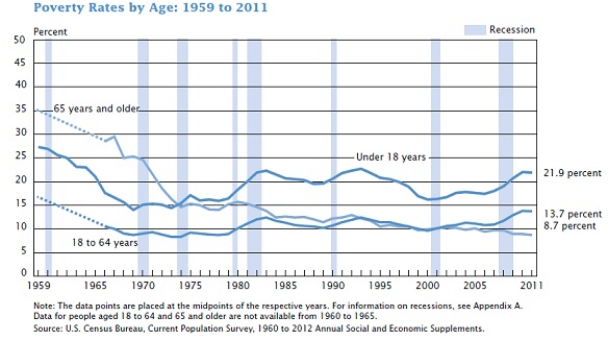

Figure 20-3  -Refer to Figure 20-3. Which of the following best describes the poverty rates by age from 1965 to 2011?

-Refer to Figure 20-3. Which of the following best describes the poverty rates by age from 1965 to 2011?

A) The poverty rates by age have declined for all age groups.

B) The percentage of people living in poverty has consistently been highest for the elderly aged 65 and over and lowest for adults aged 18 to 64.

C) The percentage of children under age 18 and the percentage of adults aged 18 to 64 have maintained a similar trend while the percentage of elderly aged 65 and over has decreased significantly.

D) The poverty rates by age have increased for all age groups.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-11

Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years

[Dollars] ![Table 20-11 Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-11. What is the poverty line for a family of three with one child? A) $17,595 B) $18,106 C) $18,123 D) $22,891](https://d2lvgg3v3hfg70.cloudfront.net/TB2269/11eb175c_fc8f_1e9f_931a_bb58b8f16319_TB2269_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a family of three with one child?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a family of three with one child?

A) $17,595

B) $18,106

C) $18,123

D) $22,891

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

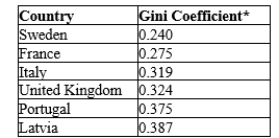

Table 20-10  *A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most equal income distribution?

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most equal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

The poverty rate is the percentage of the population whose family income falls below an absolute level called the .

Correct Answer

verified

Correct Answer

verified

Short Answer

Jermaine believes that it is important to maximize the well-being of the worst-off person in society. He believes in the principle called the .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-13

The following table shows the distribution of income in Widgetapolis.

-Refer to Table 20-13. If the poverty rate is 33%, where is the poverty line in Widgetapolis?

-Refer to Table 20-13. If the poverty rate is 33%, where is the poverty line in Widgetapolis?

A) under $39,000

B) between $39,000 and $59,999

C) between $60,000 and $81,999

D) between $82,000 and $109,999

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A disadvantage of the Earned Income Tax Credit (EITC) program is that it does not help alleviate poverty due to unemployment, sickness, or other inability to work.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which political philosophy believes that the government should equalize the incomes of all members of society?

A) Utilitarianism.

B) Liberalism.

C) Libertarianism.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2011, what percentage of U.S. families had income levels below $75,000?

A) 20 percent

B) 40 percent

C) 60 percent

D) 80 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 478

Related Exams