A) Buyers bear the entire burden of the tax.

B) Sellers bear the entire burden of the tax.

C) Buyers and sellers share the burden of the tax.

D) We have to know whether it is the buyers or the sellers that are required to pay the tax to the government in order to make this determination.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of lemonade, the

A) sellers bear the entire burden of the tax.

B) buyers bear the entire burden of the tax.

C) burden of the tax will be always be equally divided between the buyers and the sellers.

D) burden of the tax will be shared by the buyers and the sellers, but the division of the burden is not always equal.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The true burden of a payroll tax has nothing to do with the percentage of the tax that employers are required to pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

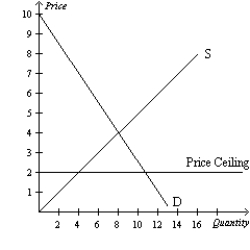

Figure 6-3

Panel (a)

Panel (b)

-Refer to Figure 6-3. A binding price floor is shown in

-Refer to Figure 6-3. A binding price floor is shown in

A) both panel (a) and panel (b) .

B) panel (a) only.

C) panel (b) only.

D) neither panel (a) nor panel (b) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Renters of rent-controlled apartments will likely benefit from both lower rents and higher quality of apartments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding, then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

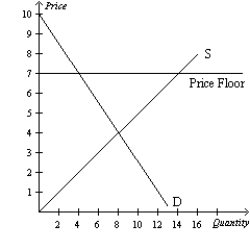

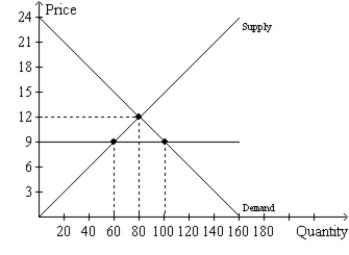

Figure 6-6  -Refer to Figure 6-6. Which of the following statements is correct?

-Refer to Figure 6-6. Which of the following statements is correct?

A) A price ceiling set at $12 would be binding, but a price ceiling set at $8 would not be binding.

B) A price floor set at $8 would be binding, but a price ceiling set at $8 would not be binding.

C) A price ceiling set at $9 would result in a surplus.

D) A price floor set at $11 would result in a surplus.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

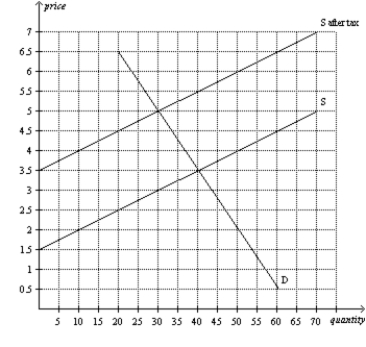

Multiple Choice

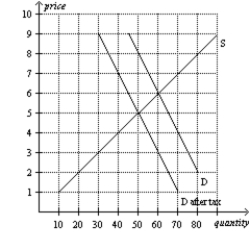

Figure 6-22  -Refer to Figure 6-22. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. After the buyers pay the tax, relative to the case depicted in the figure, the burden on buyers will be

-Refer to Figure 6-22. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. After the buyers pay the tax, relative to the case depicted in the figure, the burden on buyers will be

A) larger, and the burden on sellers will be smaller.

B) smaller, and the burden on sellers will be larger.

C) the same, and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-25  -Refer to Figure 6-25. The price that buyers pay after the tax is imposed is

-Refer to Figure 6-25. The price that buyers pay after the tax is imposed is

A) $5.

B) $6.

C) $7.

D) $8.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the demand curve is very inelastic and the supply curve is very elastic in a market, then the sellers will bear a greater burden of a tax imposed on the market, even if the tax is imposed on the buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct? A tax burden

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is less elastic.

C) falls more heavily on the side of the market that is closest to unit elastic.

D) is distributed independently of the relative elasticities of supply and demand.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Economists have two roles: scientist and policy adviser.

B) As scientists, economists develop and test theories to explain the world around them.

C) Economic policies rarely have effects that their architects did not intend or anticipate.

D) As policy advisers, economists use their theories to help change the world for the better.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

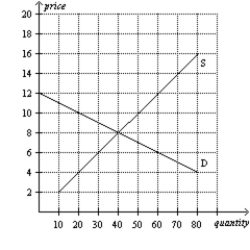

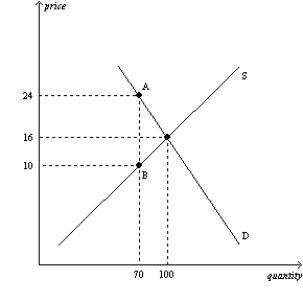

Figure 6-18

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-18. The per-unit burden of the tax on sellers is

-Refer to Figure 6-18. The per-unit burden of the tax on sellers is

A) $6.

B) $8.

C) $10.

D) $14.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

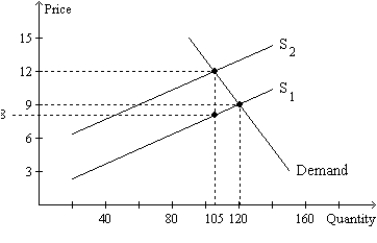

Figure 6-14  -Refer to Figure 6-14. If the horizontal line on the graph represents a price ceiling, then the price ceiling is

-Refer to Figure 6-14. If the horizontal line on the graph represents a price ceiling, then the price ceiling is

A) binding and creates a shortage of 20 units of the good.

B) binding and creates a shortage of 40 units of the good.

C) not binding but creates a shortage of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a market with a binding price control,

A) there is an imbalance between the quantity supplied by sellers and the quantity demanded by buyers.

B) the costs of production are fully reflected in the price paid.

C) the price observe reflects the scarcity of the good.

D) all of the above are true.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce the burning of fossil fuels, it should impose a tax on

A) buyers of gasoline.

B) sellers of gasoline.

C) either buyers or sellers of gasoline.

D) whichever side of the market is less elastic.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A binding price floor causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-21  -Refer to Figure 6-21. The price that buyers pay after the tax is imposed is

-Refer to Figure 6-21. The price that buyers pay after the tax is imposed is

A) $8.00.

B) $9.00.

C) $10.50.

D) $12.00.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on golf clubs will cause buyers of golf clubs to pay a higher price, sellers of golf clubs to receive a lower price, and fewer golf clubs to be sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key lesson from the payroll tax is that the

A) tax is a tax solely on workers.

B) tax is a tax solely on firms that hire workers.

C) tax eliminates any wedge that might exist between the wage that firms pay and the wage that workers receive.

D) true burden of a tax cannot be legislated.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 668

Related Exams