A) difference between the price paid by buyers after the tax is imposed and the price paid by buyers before the tax is imposed.

B) difference between the price received by sellers before the tax is imposed and the price received by sellers after the tax is imposed.

C) price of the good before the tax is imposed.

D) price of the good after the tax is imposed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true for markets in which the demand curve slopes downward and the supply curve slopes upward?

A) As the size of the tax increases, tax revenue continually rises and deadweight loss continually falls.

B) As the size of the tax increases, tax revenue and deadweight loss rise initially, but both eventually begin to fall.

C) As the size of the tax increases, tax revenue rises initially, but it eventually begins to fall; deadweight loss continually rises.

D) As the size of the tax increases, tax revenue rises initially, but it eventually begins to fall; deadweight loss falls initially, but eventually it begins to rise.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With linear demand and supply curves in a market, suppose a tax of $0.20 per unit on a good creates a deadweight loss of $40. If the tax is increased to $0.50 per unit, the deadweight loss from the new tax will be

A) $200.

B) $250.

C) $475.

D) $625.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of deadweight loss from a tax depends upon the

A) price elasticity of demand.

B) price elasticity of supply.

C) amount of the tax per unit.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

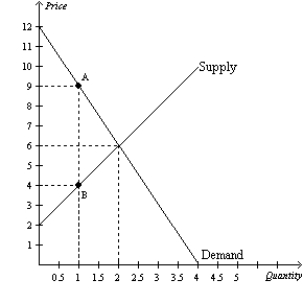

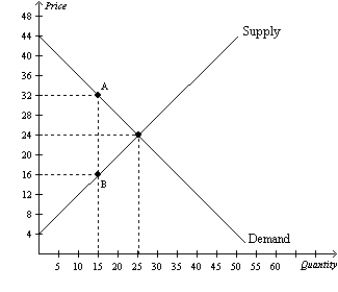

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. The imposition of the tax causes the price received by sellers to

-Refer to Figure 8-2. The imposition of the tax causes the price received by sellers to

A) decrease by $2.

B) increase by $3.

C) decrease by $4.

D) increase by $5.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

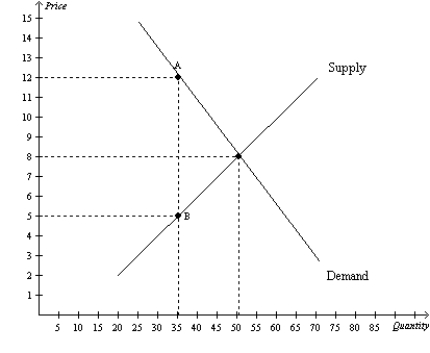

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4. The amount of tax revenue received by the government is equal to

-Refer to Figure 8-4. The amount of tax revenue received by the government is equal to

A) $245.

B) $350.

C) $490.

D) $700.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $1 per unit is imposed on a good. The more elastic the supply of the good, other things equal, the

A) smaller is the response of quantity supplied to the tax.

B) larger is the tax burden on sellers relative to the tax burden on buyers.

C) larger is the deadweight loss of the tax.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

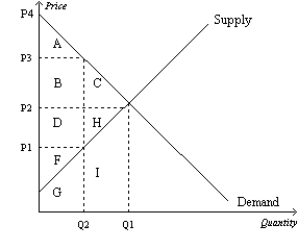

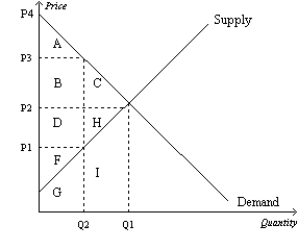

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. The benefit to the government is measured by

-Refer to Figure 8-5. The benefit to the government is measured by

A) tax revenue and is represented by area A+B.

B) tax revenue and is represented by area B+D.

C) the net gain in total surplus and is represented by area B+D.

D) the net gain in total surplus and is represented by area C+H.

F) None of the above

Correct Answer

verified

Correct Answer

verified

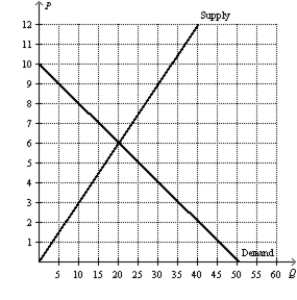

Multiple Choice

Figure 8-13  -Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The amount of tax revenue collected by the government is

-Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The amount of tax revenue collected by the government is

A) $120.

B) $80.

C) $50.

D) $30.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a tax on labor?

A) Medicare tax

B) inheritance tax

C) sales tax

D) All of the above are labor taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on a good

A) gives buyers an incentive to buy less of the good than they otherwise would buy.

B) gives sellers an incentive to produce more of the good than they otherwise would produce.

C) creates a benefit to the government, the size of which exceeds the loss in surplus to buyers and sellers.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Total surplus in a market does not change when the government imposes a tax on that market because the loss of consumer surplus and producer surplus is equal to the gain of government revenue.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7. The deadweight loss associated with this tax amounts to

-Refer to Figure 8-7. The deadweight loss associated with this tax amounts to

A) $80, and this figure represents the amount by which tax revenue to the government exceeds the combined loss of producer and consumer surpluses.

B) $80, and this figure represents the surplus that is lost because the tax discourages mutually advantageous trades between buyers and sellers.

C) $60, and this figure represents the amount by which tax revenue to the government exceeds the combined loss of producer and consumer surpluses.

D) $60, and this figure represents the surplus that is lost because the tax discourages mutually advantageous trades between buyers and sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

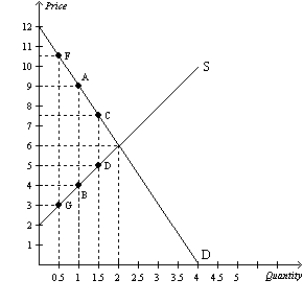

Figure 8-19

The vertical distance between points A and B represents the original tax.  -Refer to Figure 8-19. If the government changed the per-unit tax from $5.00 to $2.50, then the price paid by buyers would be $7.50, the price received by sellers would be $5, and the quantity sold in the market would be 1.5 units. Compared to the original tax rate, this lower tax rate would

-Refer to Figure 8-19. If the government changed the per-unit tax from $5.00 to $2.50, then the price paid by buyers would be $7.50, the price received by sellers would be $5, and the quantity sold in the market would be 1.5 units. Compared to the original tax rate, this lower tax rate would

A) increase government revenue and increase the deadweight loss from the tax.

B) increase government revenue and decrease the deadweight loss from the tax.

C) decrease government revenue and increase the deadweight loss from the tax.

D) decrease government revenue and decrease the deadweight loss from the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. Consumer surplus before the tax was levied is represented by area

-Refer to Figure 8-5. Consumer surplus before the tax was levied is represented by area

A) A.

B) A+B+C.

C) D+H+F.

D) F.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As more people become self-employed, which allows them to determine how many hours they work per week, we would expect the deadweight loss from the Social Security tax to

A) increase, and the revenue generated from the tax to increase.

B) increase, and the revenue generated from the tax to decrease.

C) decrease, and the revenue generated from the tax to increase.

D) decrease, and the revenue generated from the tax to decrease.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the government imposes a $3 tax in a market, the equilibrium price will rise by $3.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The most important tax in the U.S. economy is the tax on corporations' profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes cause deadweight losses because they

A) lead to losses in surplus for consumers and for producers that, when taken together, exceed tax revenue collected by the government.

B) distort incentives to both buyers and sellers.

C) prevent buyers and sellers from realizing some of the gains from trade.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a good is taxed,

A) both buyers and sellers of the good are made worse off.

B) only buyers are made worse off, because they ultimately bear the burden of the tax.

C) only sellers are made worse off, because they ultimately bear the burden of the tax.

D) neither buyers nor sellers are made worse off, since tax revenue is used to provide goods and services that would otherwise not be provided in a market economy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 509

Related Exams