Correct Answer

verified

Correct Answer

verified

True/False

Before a stock dividend can be declared or paid, there must be sufficient cash.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On June 5, Belen Corporation reacquired 3,300 shares of its own common stock at $45 per share. On July 15, Belen sold 2,000 of the reacquired shares at $48 per share. On August 30, Belen sold the remaining shares at $42 per share.Journalize the transactions of June 5, July 15, and August 30.

Correct Answer

verified

Correct Answer

verified

True/False

The number of shares of outstanding stock is equal to the number of shares authorized minus the number of shares issued.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Vincent Corporation has 100,000 shares of $100 par common stock outstanding. On June 30, Vincent Corporation declared a 5% stock dividend to be issued on July 30 to stockholders of record July 15. The market price of the stock was $132 a share on June 30. Journalize the entries required on June 30, July 15, and July 30.

Correct Answer

verified

Correct Answer

verified

Essay

Firefly, Inc. reported the following results for the year ending July 31:Retained earnings, August 1$875,000Net income450,000Cash dividends declared140,000Stock dividends declared60,000Prepare a retained earnings statement for the fiscal year ended July 31.

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following selected transactions completed during the current fiscal year:Mar. 24The board of directors of New Town, Inc. declared a stock split that reduced the par of common shares from $100 to $20. This action increased the number of outstanding shares to 500,000.26Declared a dividend of $1.75 per share on the outstanding shares of common stock.Apr. 5Paid the dividend declared on March 26.Nov. 1Declared a 5% stock dividend on the common stock outstanding (the fair market value of the stock to be issued is $25).Dec. 1Issued the certificates for the common stock dividend declared on November 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Retained earnings

A) is the same as contributed capital

B) cannot have a debit balance

C) changes are summarized in the retained earnings statement

D) is equal to cash on hand

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Prepare entries to record the following: (a)Issued 1,000 shares of $10 par common stock at $59 for cash. (b)Issued 1,400 shares of $10 par common stock in exchange for equipment with a fair market price of $60,000. (c)Purchased 100 shares of treasury stock at $32. (d)Sold the 100 shares of treasury stock purchased in (c) at $42.

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation is liquidated, preferred stockholders are paid before the creditors and before the common stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company has preferred stock, the preferred stock dividend is added to net income when computing earnings per common share.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the board of directors declares a cash or stock dividend, this action decreases retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a reason for a corporation to buy back its own stock?

A) resale to employees

B) bonus to employees

C) support the market price of the stock

D) increase the shares outstanding

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

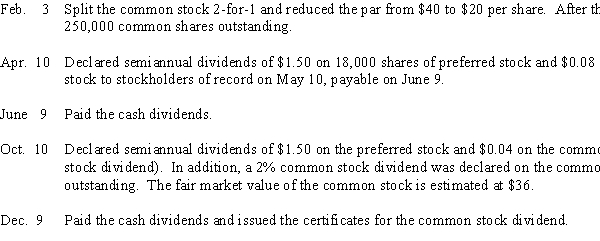

Selected transactions completed by Breezeway Construction during the current fiscal year are as follows:  RequiredJournalize these transactions.

RequiredJournalize these transactions.

Correct Answer

verified

Correct Answer

verified

True/False

The main source of paid-in capital is from issuing stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 50,000 shares are authorized, 41,000 shares are issued, and 2,000 shares are reacquired, the number of outstanding shares is 43,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total stockholders' equity based on the following account balances?

A) $670,000

B) $655,000

C) $640,000

D) $565,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Dakota Company issues 1,500 shares of $6 par common stock for $75,000,

A) Common Stock will be credited for $75,000

B) Paid-In Capital in Excess of Par will be credited for $9,000

C) Paid-In Capital in Excess of Par will be credited for $66,000

D) Cash will be debited for $66,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that retained earnings had a beginning balance of $75,000. Match the following amounts to the appropriate term (a-h) . -Preferred Stock = Number of Shares of Preferred Stock Issued × Par Value of Preferred Stock = 3,000 × $50 = $150,000

A) Treasury stock

B) Retained earnings

C) Preferred stock

D) Excess of issue price over par (preferred)

E) Common stock

F) Total paid-in capital

G) Excess of issue price over par (common)

H) Total stockholders' equity

J) A) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of a corporation?

A) It may enter into binding legal contracts in its own name.

B) It may sue and be sued.

C) The acts of its owners bind the corporation.

D) It may buy, own, and sell property.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 217

Related Exams