A) added to net income

B) deducted from net income

C) ignored because it does not affect cash

D) reported supplementally as a noncash investing and financing activity

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

A) the Cash flows from financing activities section

B) the Cash flows from investing activities section

C) a separate schedule

D) the Cash flows from operating activities section

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Loss on sale of equipment

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

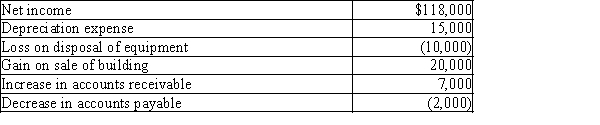

Kennedy, Inc. reported the following data:?  Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Essay

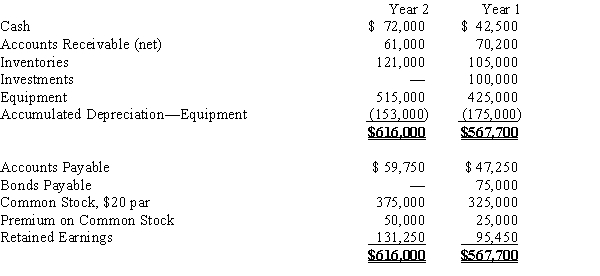

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the Cash flows from financing activities section would include

A) receipts from the sale of investments

B) payments for the acquisition of investments

C) receipts from a note receivable

D) receipts from the issuance of capital stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of reporting cash flows from operations, the primary source of cash is cash received from customers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the operating activities section of the statement of cash flows reports major classes of cash receipts and cash payments related to the day-to-day operations of the business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from operating activities, as part of the statement of cash flows, include cash transactions that enter into the determination of net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

A) depreciation expense

B) gain on sale of land

C) a loss on the sale of equipment

D) dividends declared and paid

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method, expenses that do not affect cash are added to net income in the operating activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question. -Exchange of land for common stock

A) Increase cash from operating activities

B) Decrease cash from operating activities

C) Increase cash from investing activities

D) Decrease cash from investing activities

E) Increase cash from financing activities

F) Decrease cash from financing activities

G) Noncash investing and financing supplement

I) B) and C)

Correct Answer

verified

G

Correct Answer

verified

True/False

To determine cash payments for merchandise for the statement of cash flows using the direct method, a decrease in accounts payable is added to the cost of merchandise sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating cash flow available for company use after purchasing the fixed assets that are necessary to maintain current productive capacity is called the

A) free cash flow

B) modified cash flow

C) PPE cash flow

D) restricted cash flow

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following increases cash?

A) depreciation expense

B) acquisition of treasury stock

C) borrowing money by issuing a six-month note

D) the declaration of a cash dividend

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firefly Inc. sold land for $225,000 cash. The land had been purchased five years earlier for $275,000. The loss on the sale was reported on the income statement. On the statement of cash flows, what amount should Firefly report as an investing activity from the sale of the land?

A) $225,000

B) $275,000

C) $50,000

D) $500,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable from sales to customers amounted to $40,000 and $32,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $110,000. Exclusive of the effect of other adjustments, the net cash flows from operating activities to be reported on the statement of cash flows using the indirect method is

A) $118,000

B) $110,000

C) $102,000

D) $150,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Land costing $140,000 was sold for $173,000 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?

A) $173,000

B) $140,000

C) $313,000

D) $33,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation uses the indirect method for preparing the statement of cash flows. A fixed asset has been sold for $25,000 representing a gain of $4,500. The value in the operating activities section regarding this event would be

A) $25,000

B) $(4,500)

C) $29,500

D) $4,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash receipts received from the issuance of a mortgage notes payable would be classified as a (n)

A) investing activity

B) operating activity

C) noncash investing and financing activity

D) financing activity

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 189

Related Exams