B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the Federal income tax formula for individuals, a choice must be made between claiming deductions for AGI and itemized deductions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After Ellie moves out of the apartment she had rented as her personal residence, she recovers her damage deposit of $1,000.The $1,000 is not income to Ellie.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because they appear on page 1 of Form 1040, itemized deductions are also referred to as "page 1 deductions."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ayla, age 17, is claimed by her parents as a dependent.During 2018, she had interest income from a bank savings account of $2,000 and income from a part-time job of $4,200.Ayla's taxable income is:

A) $4,200 - $4,550 = $0.

B) $6,200 - $5,700 = $500.

C) $6,200 - $4,550 = $1,650.

D) $6,200 - $1,000 = $5,200.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As opposed to itemizing deductions from AGI, the majority of individual taxpayers choose the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For the year a spouse dies, the surviving spouse is considered married for the entire year for income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Once they reach age 65, many taxpayers will switch from itemizing their deductions from AGI and start claiming the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Monique is a resident of the U.S.and a citizen of France.If she files a U.S.income tax return, Monique cannot claim the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A qualifying child cannot include:

A) A nonresident alien.

B) A married son who files a joint return.

C) A daughter who is away at college.

D) A brother who is 28 years of age and disabled.

E) A grandmother.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Claude's deductions from AGI exceed the standard deduction allowed for the current year.Under these circumstances, Claude cannot claim the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In January 2018, Jake's wife dies and he does not remarry.For tax year 2018, Jake may not be able to use the filing status available to married persons filing joint returns.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

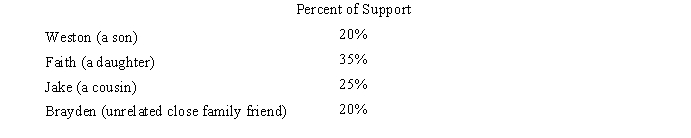

Millie, age 80, is supported during the current year as follows:  During the year, Millie lives in an assisted living facility.Under a multiple support agreement, indicate which parties can qualify to claim Millie as a dependent.

During the year, Millie lives in an assisted living facility.Under a multiple support agreement, indicate which parties can qualify to claim Millie as a dependent.

A) Weston and Faith.

B) Faith.

C) Weston, Faith, Jake, and Brayden.

D) Faith, Jake, and Brayden.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Currently, the top income tax rate in effect is not the highest it has ever been.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When separate income tax returns are filed by married taxpayers, one spouse cannot claim the other spouse as an exemption.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items, if any, is deductible?

A) Parking expenses incurred in connection with jury duty-taxpayer is a dentist.

B) Substantiated gambling losses not in excess of gambling winnings) from state lottery.

C) Contributions to mayor's reelection campaign.

D) Speeding ticket incurred while on business.

E) Premiums paid on personal life insurance policy.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Once a child reaches age 19, the kiddie tax no longer applies.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The filing status of a taxpayer e.g., single, head of household) must be identified before the applicable standard deduction is determined.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Surviving spouse filing status begins in the year in which the deceased spouse died.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For tax purposes, married persons filing separate returns are treated the same as single taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 105

Related Exams