A) individual income tax.

B) social insurance tax.

C) corporate income tax.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the total amount spent in retail stores is called

A) a sales tax.

B) an excise tax.

C) a retail tax.

D) an income tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As government debt increases,

A) Congress will reduce spending by an equal proportion.

B) the government must spend more revenue on interest payments.

C) a trade-off with government deficits is inevitable.

D) tax rates must rise to cover the deficit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate exceeds the average tax rate,the tax is

A) proportional.

B) regressive.

C) non-egalitarian.

D) progressive.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000,your marginal tax rate is

A) 8 percent.

B) 12.5 percent.

C) 20 percent.

D) unknown.We do not have enough information to answer this question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government taxes 30 percent of the first $70,000 and 50 percent of all income above $70,000.For a person earning $200,000,the marginal tax rate is

A) 30 percent,and the average tax rate is 50 percent.

B) 30 percent,and the average tax rate is 43 percent.

C) 50 percent,and the average tax rate is 40 percent.

D) 50 percent,and the average tax rate is 43 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

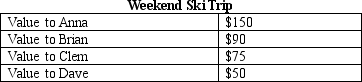

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $12 on skiing,which raises the price of a weekend ski pass to $57.What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $12 on skiing,which raises the price of a weekend ski pass to $57.What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $41.

B) $95.

C) $144.

D) $185.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some colleges charge all students the same fee for access to campus computing services.Suppose that students differ by how many hours of campus computing services they use.For example,some students print all their papers and assignment in the campus computer labs,while others use their own printers in their apartments.The computing services fee is most like a(n)

A) excise tax that conforms to the benefits principle.

B) excise tax that violates the benefits principle.

C) lump-sum tax that conforms to the benefits principle.

D) lump-sum tax that violates the benefits principle.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Equity is more important than efficiency as a goal of the tax system.

B) Efficiency is more important than equity as a goal of the tax system.

C) Both equity and efficiency are important goals of the tax system.

D) Neither equity nor efficiency is an important goal of the tax system.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claim that all citizens should make an "equal sacrifice" to support government programs is usually associated with

A) the ability-to-pay principle.

B) the benefits principle.

C) efficiency arguments.

D) regressive tax arguments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight losses because they

A) reduce costs for firms.

B) distort incentives.

C) cause prices to decrease.

D) create revenue for the government.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government taxes income in the following fashion: 30 percent of the first $20,000,50 percent of the next $30,000,and 60 percent of all income over $50,000.Ted earns $40,000,and Robin earns $60,000.Which of the following statements is correct?

A) Ted's marginal tax rate is 60 percent,and his average tax rate is 50 percent.

B) Ted's marginal tax rate is 50 percent,and his average tax rate is 40 percent.

C) Robin's marginal tax rate is 50 percent,and her average tax rate is 45 percent.

D) Robin's marginal tax rate is 60 percent,and her average tax rate is 40 percent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle of taxation can be used to argue that wealthy citizens should pay higher taxes than poorer ones on the basis that

A) police services are more frequently used in poor neighborhoods.

B) the wealthy benefit more from services provided by government than the poor.

C) the poor are more active in political processes.

D) the poor receive welfare payments.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income tax owed by a family is

A) not simply proportional to its total income.

B) unaffected by deductions.

C) total income minus tax credits.

D) a constant fraction of income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If Mary earns $80,000 in taxable income and pays $40,000 in taxes,her marginal tax rate must be 50 percent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity can be difficult to assess because it is difficult to compare the similarity of tax payers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of a tax is

A) the reduction in economic welfare of taxpayers that exceeds the revenue raised by the government.

B) the improved efficiency created as people reallocate resources according to the tax incentive rather than the true costs and benefits.

C) the loss in tax revenues.

D) Both a and b are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

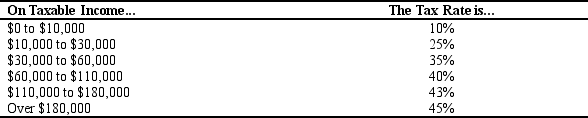

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tim earns income of $60,000 per year and pays $21,000 per year in taxes.Tim paid 20 percent in taxes on the first $30,000 he earned.What was the marginal tax rate on the second $30,000 he earned?

A) 20 percent

B) 30 percent

C) 50 percent

D) 70 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 499

Related Exams