B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

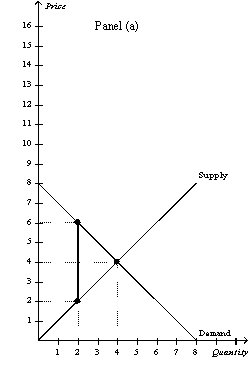

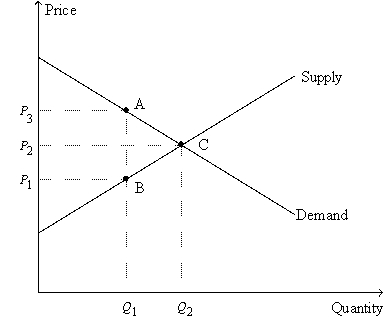

Figure 8-13

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

A) When demand is relatively inelastic,the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic,the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic,the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic,the deadweight loss of a tax is larger than when supply is relatively inelastic.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price elasticities of supply and demand affect

A) both the size of the deadweight loss from a tax and the tax incidence.

B) the size of the deadweight loss from a tax but not the tax incidence.

C) the tax incidence but not the size of the deadweight loss from a tax.

D) neither the size of the deadweight loss from a tax nor the tax incidence.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following quantities decrease in response to a tax on a good?

A) the equilibrium quantity in the market for the good,the effective price of the good paid by buyers,and consumer surplus

B) the equilibrium quantity in the market for the good,producer surplus,and the well-being of buyers of the good

C) the effective price received by sellers of the good,the wedge between the effective price paid by buyers and the effective price received by sellers,and consumer surplus

D) None of the above is necessarily correct unless we know whether the tax is levied on buyers or on sellers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Taxes on labor tend to encourage the elderly to retire early.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

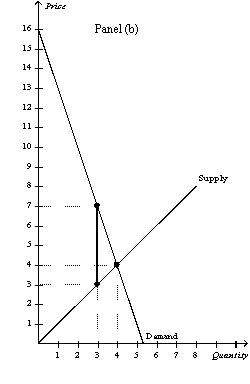

Figure 8-20.The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.  -Refer to Figure 8-20.For an economy that is currently at point D on the curve,a decrease in the tax rate would

-Refer to Figure 8-20.For an economy that is currently at point D on the curve,a decrease in the tax rate would

A) decrease consumer surplus.

B) decrease producer surplus.

C) increase tax revenue.

D) increase the deadweight loss of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

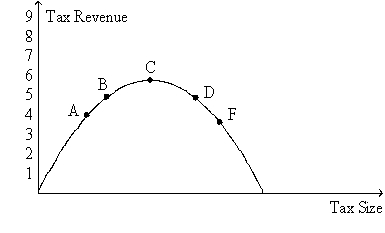

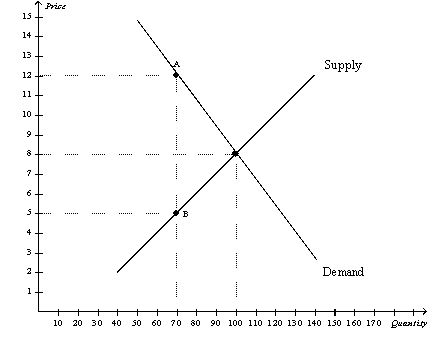

Figure 8-9

The vertical distance between points A and C represent a tax in the market.  -Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to decrease by

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to decrease by

A) $20.

B) $200.

C) $300.

D) $500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

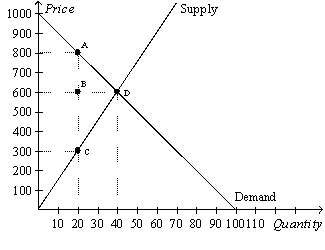

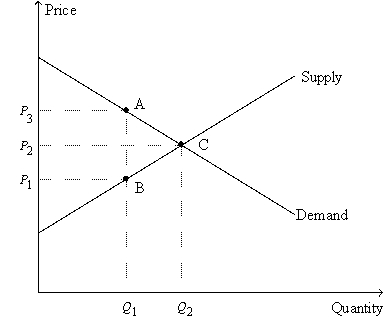

Figure 8-11  -Refer to Figure 8-11.The size of the tax is represented by the

-Refer to Figure 8-11.The size of the tax is represented by the

A) length of the line segment connecting points A and B.

B) length of the line segment connecting points A and C.

C) length of the line segment connecting points B and C.

D) area of the triangle bounded by the points A,B,and C.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who once said that taxes are the price we pay for a civilized society?

A) Milton Friedman

B) Theodore Roosevelt

C) Arthur Laffer

D) Oliver Wendell Holmes,Jr.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The higher a country's tax rates,the more likely that country will be

A) at the top of the Laffer curve.

B) on the positively sloped part of the Laffer curve.

C) on the negatively sloped part of the Laffer curve.

D) experiencing small deadweight losses.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buyers of a product will bear the larger part of the tax burden,and sellers will bear a smaller part of the tax burden,when the

A) tax is placed on the sellers of the product.

B) tax is placed on the buyers of the product.

C) supply of the product is more elastic than the demand for the product.

D) demand for the product is more elastic than the supply of the product.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Tax revenue equals the size of the tax multiplied by the quantity sold in the market after the tax is levied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The amount of the tax on each unit of the good is

-Refer to Figure 8-4.The amount of the tax on each unit of the good is

A) $5.

B) $7.

C) $8.

D) $12.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

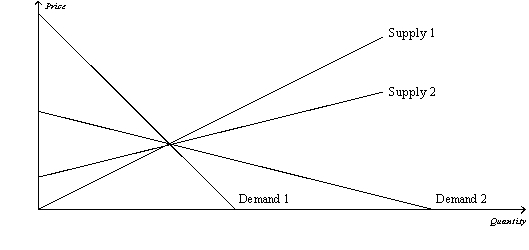

Figure 8-12  -Refer to Figure 8-12.Which of the following statements is not correct?

-Refer to Figure 8-12.Which of the following statements is not correct?

A) Supply 2 is more elastic than supply 1.

B) Demand 2 is more elastic than demand 1.

C) Supply 1 is more inelastic than supply 2.

D) Demand 2 is more inelastic than supply 2.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The more elastic the supply,the larger the deadweight loss from a tax,all else equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11.The price labeled as P1 on the vertical axis represents the price

-Refer to Figure 8-11.The price labeled as P1 on the vertical axis represents the price

A) received by sellers before the tax is imposed.

B) received by sellers after the tax is imposed.

C) paid by buyers before the tax is imposed.

D) paid by buyers after the tax is imposed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the tax on gasoline is raised from $0.50 per gallon to $2.50 per gallon.As a result,

A) tax revenue necessarily increases.

B) the deadweight loss of the tax necessarily increases.

C) the demand curve for gasoline necessarily becomes steeper.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Tax revenue is more likely to increase when a low tax rate is increased than when a high tax rate is increased.

B) Tax revenue is less likely to increase when a low tax rate is increased than when a high tax rate is increased.

C) Tax revenue is likely to increase by the same amount when a low tax rate is increased and when a high tax rate is increased.

D) Decreasing a tax rate can never increase tax revenue.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The loss in total surplus resulting from a tax is called

A) a deficit.

B) economic loss.

C) deadweight loss.

D) inefficiency.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a tax on labor?

A) Medicare tax

B) inheritance tax

C) sales tax

D) All of the above are labor taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 453

Related Exams