A) As though it were a C corporation.

B) As though it were a unitary business.

C) As a flow-through entity, similar to its Federal income tax treatment.

D) LLCs typically are exempted from state income taxation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All of the U.S. states have adopted a tax based on the net taxable income of corporations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A unitary group of entities files a combined return that includes all of the affiliates' income and apportionment data.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A use tax applies when a State A resident purchases:

A) A new automobile from a State A dealership.

B) A used automobile from the web site of a State A dealership.

C) A new automobile from a State B dealership, then using the car back at home.

D) A new automobile that is purchased from an online seller.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -A garment purchased by an employee for wear at an office job.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zhao Company sold an asset on the first day of the tax year for $500,000. Zhao's Federal tax basis for the asset was $300,000. Because of differences in cost recovery schedules, the state regular-tax basis in the asset was $350,000. What adjustment, if any, should be made to Zhao's Federal taxable income in determining the correct taxable income for the typical state?

A) $0

B) ($50,000)

C) $50,000

D) $150,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Almost all of the states assess some form of consumer-level sales/use tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

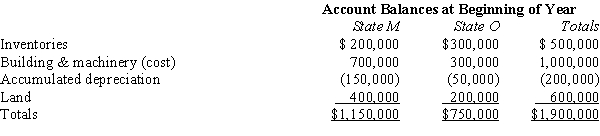

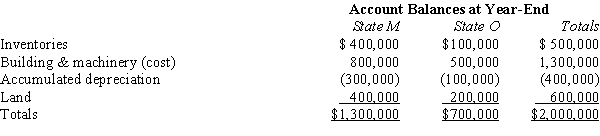

Valdez Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's O property factor is:

Valdez's O property factor is:

A) 35.0%.

B) 37.2%.

C) 39.5%.

D) 53.8%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The typical state sales/use tax falls on sales of both real and personal property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -Federal depreciation deduction in excess of state amount.

A) Addition modification

B) Subtraction modification

C) No modification

E) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in applying the P.L. 86-272 definition of solicitation -Owning a tablet computer that is used on sales trips to the state.

A) More than solicitation, creates nexus

B) Solicitation only, no nexus created

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

The individual seller of a used auto should collect and remit sales tax to the state.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In conducting multistate tax planning, the taxpayer should:

A) Review tax opportunities in light of their effect on the overall business.

B) Exploit inconsistencies among the taxing statutes and formulas of the states.

C) Consider the tax effects of the plan after accounting for any new compliance and administrative costs that it generates.

D) All of the above are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not immune from state income taxation, even if P.L. 86-272 is in effect?

A) Sale of office equipment that is used in the taxpayer's business.

B) Sale of office equipment that constitutes inventory to the purchaser.

C) Sale of a warehouse used in the taxpayer's business.

D) All of the above are protected by P.L. 86-272 immunity provisions.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Typically included in the sales/use tax base is the purchase of tablet computers and cell phone equipment by a large manufacturing firm, whose sales force uses the items.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following events, considered independently, to its likely effect on WillCo's various apportionment factors. WillCo is based in Q and has customers in Q, R, and S. To this point, WillCo has not established nexus with S. More than one choice may be correct -Q adopts a throwback rule.

A) No change in apportionment factors

B) Q apportionment factor increases

C) Q apportionment factor decreases

D) R apportionment factor increases

E) R apportionment factor decreases

F) S apportionment factor increases

G) S apportionment factor decreases

I) D) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -Dividend income from P & G stock held.

A) Addition modification

B) Subtraction modification

C) No modification

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

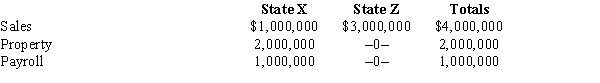

Marquardt Corporation realized $900,000 taxable income from the sales of its products in States X and Z. Marquardt's activities establish nexus for income tax purposes in both states. Marquardt's sales, payroll, and property among the states include the following.  Z utilizes an equally weighted three-factor apportionment formula. Marquardt is incorporated in X. How much of Marquardt's taxable income is apportioned to Z?

Z utilizes an equally weighted three-factor apportionment formula. Marquardt is incorporated in X. How much of Marquardt's taxable income is apportioned to Z?

A) $0

B) $225,000

C) $675,000

D) $3,000,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The typical local property tax falls on both an investor's principal residence and her stock portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A service engineer spends 80% of her time maintaining the employer's productive business property and 20% maintaining the employer's nonbusiness rental properties. This year, her compensation totaled $90,000. The payroll factor assigns $90,000 to the state in which the employer is based.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 123

Related Exams