Correct Answer

verified

The § 199 deduction is determined at the...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

An item that appears in the "Other Adjustments Account" affects stock basis,but not AAA,such as tax-exempt interest.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Where the S corporation rules are silent,C corporation provisions apply.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Post-termination distributions by a former S corporation that are charged against ____________________ do not get tax-free treatment. OAA

Correct Answer

verified

Correct Answer

verified

True/False

A distribution of cash or other property by an S corporation to shareholders that does not exceed the balance of AAA during a one-year period following an S election termination receives special capital gain treatment.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Explain the OAA concept.

Correct Answer

verified

S corporations report changes in the AAA...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

When an S corporation liquidates,which of its tax attributes disappear?

A) AAA.

B) AEP.

C) Suspended losses.

D) All of the above items disappear.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income at the corporate level flows through as exempt to S shareholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mock Corporation converts to S corporation status in 2013.Mock used the LIFO inventory method in 2012 and had a LIFO inventory of $435,000 (FIFO value of $550,000) on the date of the S election.How much tax must be added to Mock's 2012 corporate tax liability,assuming that Mock is subject to a 35% tax rate.

A) $0.

B) $10,062.50.

C) $40,250.

D) $115,000.

E) Some other amount.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Schedule M-3 is the same for a C corporation and an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Shareholders owning a(n)____________________ of shares (voting and nonvoting)may ____________________ revoke an election. majority,voluntarily

Correct Answer

verified

majority,v...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

An S corporation may not amortize its organization expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

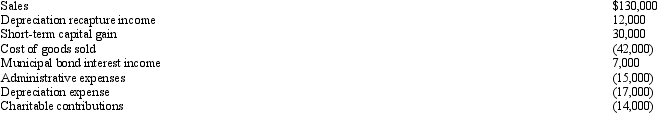

Bidden,Inc.,a calendar year S corporation,incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which corporation is eligible to make the S election?

A) Non-U.S.corporation.

B) Limited liability company.

C) Insurance company.

D) U.S.bank.

E) None of the above can select S status.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Compare the distribution of property rules for an S corporation with the corresponding partnership rules.

Correct Answer

verified

The major difference involves distributi...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

On December 31,2013,Erica Sumners owns one share of an S corporation's 10 outstanding shares of stock.The basis of Erica's share is $300.During 2014,the S corporation incurs a loss of $3,650.Determine the amount of the loss allocated to Erica,and calculate her stock basis at the end of 2014.

Correct Answer

verified

The loss assigned to each day of the S c...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

It is not beneficial for an S corporation to issue § 1244 stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Form 1120S provides an S shareholder's computation of his or her stock basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is decreased by distributions treated as being paid from AAA.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Non-separately computed loss ____________________ a S shareholder's stock basis. reduces

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 146

Related Exams