A) include a description in the notes to the financial statements.

B) record the amount of the liability times the probability of its occurrence.

C) record the amount of the liability as a long-term liability on the balance sheet.

D) exclude the information about the contingent liability from its financial statements and footnotes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company receives $95 for merchandise sold to a consumer,of which $5 is for sales tax.The $5 of sales tax:

A) increases sales revenue.

B) increases current liabilities.

C) increases selling expenses.

D) is not recorded.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

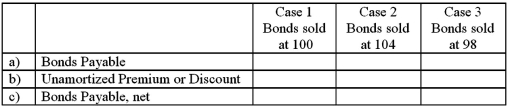

Part I

FWP Co.issued $100,000,10-year bonds on January 1,2013.The stated rate of interest on the bonds is 10% payable annually on 12/31.Provide the requested information for the bonds immediately after issuance (January 1,2013)under each of the three independent scenarios described below:  Part II

On January 1,2014,FWP sells $2 million of 8% bonds at face value with interest to be paid at the end of each year.Prepare the journal entries on the following dates:

a)January 1,2014 (the initial bond sale).

b)March 31,2014 (the end of the first quarter).

c)December 31,2014 (the payment of interest at the end of the year;assume that the interest owed for each of the first three quarters has been properly accrued).

Part II

On January 1,2014,FWP sells $2 million of 8% bonds at face value with interest to be paid at the end of each year.Prepare the journal entries on the following dates:

a)January 1,2014 (the initial bond sale).

b)March 31,2014 (the end of the first quarter).

c)December 31,2014 (the payment of interest at the end of the year;assume that the interest owed for each of the first three quarters has been properly accrued).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.How would this information be reported on the balance sheet at the end of the first quarter?

A) $400 as interest expense and $20,000 under long-term debt.

B) $400 as interest payable,$5,000 as current portion of long-term debt under current liabilities,and $15,000 under long-term debt.

C) $1,600 of interest under current liabilities,$5,000 as current portion of long-term debt under current liabilities and $15,000 under long-term debt.

D) $400 as interest payable under current liabilities and $20,000 under long-term debt.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What is the employer's payroll tax expense for the week?

A) $113.00

B) $119.20

C) $174.20

D) $235.40

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IBM is planning to issue $1,000 bonds with a stated interest rate of 7% and a maturity date of July 15,2022.If interest rates rise in the economy so that similar financial investments pay 9%,IBM will:

A) not be able to issue the bonds because no one will buy them.

B) receive a higher issue price to compensate buyers for the lower stated interest rate.

C) have to accept a lower issue price to attract buyers.

D) have to reprint the bond certificates to change the stated interest rate to 9%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Bonds allow a company to borrow large sums of money from many different investors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

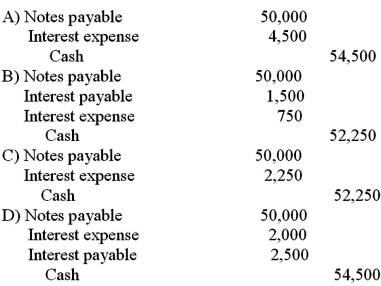

Use the information above to answer the following question.What is the entry to record the payment at the maturity date of the note?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities could include all of the following except:

A) accounts payable due in 30 days.

B) notes payable due in 9 months.

C) a bank loan due in 18 months.

D) any part of long-term debt due during the current period.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the account entitled Premium on Bonds Payable?

A) It is an account that increases when amortization entries are made.

B) It is an account that appears on the balance sheet of the issuer as a deduction from bonds payable.

C) It is an account that decreases when amortization entries are made and its balance is equal to zero at the maturity date of the bond.

D) It is a contra account with a normal debit balance.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A contingent liability:

A) is always a specific amount.

B) is an obligation arising from the purchase of goods or services on credit.

C) is an obligation not requiring a future payment.

D) is a potential obligation that depends on a future event.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

FICA payments consist of Social Security taxes and Medicare taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest on an obligation is recorded

A) as time passes.

B) when goods are purchased on account.

C) at maturity.

D) when a bank loan is obtained.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A discount on bonds payable is reported in the financial statements as:

A) a reduction from the bond liability on the balance sheet.

B) an expense on the income statement.

C) an asset on the balance sheet.

D) revenue on the income statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds that are backed by a company's assets are called secured bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative times interest earned ratio suggests that the company:

A) is using resources very efficiently.

B) has a serious financial problem.

C) has a very high interest expense.

D) has a high level of sales revenue.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During one pay period,your company distributes $130,500 to employees as net pay.The income tax withholdings were $19,000 and the FICA withholdings were $5,000.The total wages and payroll tax expense to the company for this pay period,excluding any unemployment taxes,was:

A) $149,500.

B) $130,500.

C) $154,500.

D) $159,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using straight-line amortization,when a bond is sold at a discount:

A) bonds payable declines by a constant amount each year.

B) interest expense declines by a constant amount each year.

C) bonds payable,net of discount,declines by a constant amount each year.

D) interest expense is a constant amount each year.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true for a 10-year bond issued at a discount?

A) At the end of ten years,the balance in the Discount on Bonds Payable account will equal 0.

B) At the end of ten years,the carrying value will equal the face value.

C) At the end of ten years,the total interest expense will reflect the market rate of interest.

D) At the end of ten years,the total interest expense will equal the total interest paid.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.A company pays $9,000 in interest on notes consisting of $6,000 of interest that was accrued during the last accounting period and $3,000 of interest that accumulated during this accounting period that has not yet been accrued on the books.The journal entry for the interest payment should:

A) debit Interest Expense $9,000 and credit Cash $9,000.

B) debit Cash $9,000 and credit Interest Payable $9,000.

C) debit Interest Expense $3,000,debit Interest Payable $6,000,and credit Cash $9,000.

D) debit Interest Payable $6,000,debit Accrued Interest $3,000,and credit Cash $9,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 145

Related Exams