A) debit to Discount on Bonds Payable.

B) credit to Cash.

C) credit to Interest Payable.

D) debit to Bonds Payable.

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

On October 1,2013,you borrow $200,000 at 6% interest and record the promissory note.In April and again in October of the following year,you are required to pay half the annual interest to your creditor.On December 31,2013,your adjusting journal entry for the quarter should:

A) debit Interest Expense for $3,000 and credit Interest Payable for $3,000.

B) debit Interest Payable for $3,000 and credit Interest Expense for $3,000.

C) debit Interest Expense for $6,000 and credit Cash for $6,000.

D) debit Interest Expense for $6,000 and credit Interest Payable for $6,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding bonds payable net of a discount or premium is not true?

A) If a company records a discount or premium with the bonds payable in a single account called Bonds Payable,Net,it is using the simplified effective interest method of amortization.

B) When bonds payable are accounted for net of a discount,the initial amount recorded in the Bonds Payable,Net account is the issue price of the bond.

C) When the Simplified Approach (Effective-interest Method) of amortization is used,the balance in the Bonds Payable,Net account will increase as the bond approaches the maturity date.

D) If a company issued bonds at their face value,the balance of Bonds Payable,Net account will always be equal to the face value of the bonds as long as the bonds are outstanding.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company issues bonds that do not pay periodic interest,the bonds are called:

A) convertible bonds.

B) debenture bonds.

C) serial bonds.

D) zero-coupon bonds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding loan terminology is true?

A) Loan covenants are the collateral provided by a borrower to a lender as security on a loan.

B) A secured loan means that the borrower has a pre-approved line of credit backing the debt.

C) Lenders can revise loan terms if a borrower violates a loan covenant.

D) All companies are able to establish lines of credit which will allow them to borrow money as needed,up to a prearranged limit.

F) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.If the straight-line method of amortization is used,how much total interest expense would be recorded in 2013?

A) $1,840

B) $840

C) $1,000

D) $864

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the times interest earned ratio declines,the likelihood of default on liabilities increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company receives $102,000 when it issues a bond with a face value of $100,000 and a stated interest rate of 7%.Which of the following statements is true?

A) The annual interest expense is $7,000.

B) The market interest rate is 7%.

C) A contra account to bonds payable is not needed.

D) The carrying value of the bonds will be $100,000 at maturity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

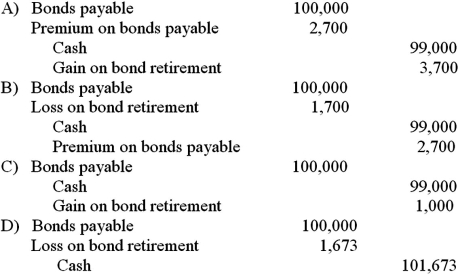

A company has bonds outstanding with a face value of $100,000.The unamortized premium on these bonds is $2,700.If the company retired these bonds at a call price of 99,the journal entry to record this retirement is:

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The annual interest payment on bonds:

A) increases over the life of the bonds when bonds are issued at a discount.

B) decreases over the life of the bonds when bonds are issued at a discount.

C) stays constant over the life of the bonds,regardless of whether bonds are issued at par,a discount,or a premium.

D) increases over the life of the bonds under the effective-interest method,but stays constant under the straight-line method of amortization.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would help a company improve its quick ratio?

A) Borrowing money on a long-term note just before the end of the accounting period.

B) Shifting resources from long-term assets to supplies and inventory.

C) Shifting obligations from long-term liabilities to short-term liabilities.

D) Acquiring inventory by issuing a long-term note.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company issued bonds at a discount.Which of the following statements is not true?

A) The contra liability account,Discount on Bonds Payable,is amortized each year by shifting part of its balance to interest expense.

B) As the current date approaches the maturity date,the carrying value of the bond approaches the face value of the bond.

C) At the date of issuance,the market interest rate was higher than the stated interest rate.

D) The account used to record the discount is a normal credit balance account.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contingent liabilities must be recorded if:

A) the future event is reasonably possible.

B) the amount owed cannot be reasonably estimated.

C) the future event is probable and the amount owed can be reasonably estimated.

D) the future event is remote.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes a contingent liability?

A) The amount of a contingent liability is known and will definitely have to be paid in the future.

B) A contingent liability is a potential liability that has arisen because of a past transaction or event,but its ultimate outcome will not be known until a future event occurs or fails to occur.

C) A contingent liability will only be incurred if a particular future event takes place.

D) A contingent liability is a potential liability that will be incurred if a natural disaster happens.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate bond with a face value of $1,000 is issued at 107.This means that the bond actually sold for:

A) $107,and the stated interest rate was higher than the market interest rate.

B) $1,070,and the stated interest rate was higher than the market interest rate.

C) $107,and the stated interest rate was lower than the market interest rate.

D) $1,070,and the stated interest rate was lower than the market interest rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some bonds allow the issuing company to retire the bond with cash at any time.These bonds are known as:

A) convertible bonds.

B) debenture bonds.

C) callable bonds.

D) coupon bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some bonds allow the borrower to repay the bond by issuing stock.These bonds are known as:

A) convertible bonds.

B) debenture bonds.

C) callable bonds.

D) coupon bonds.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering buying a bond from a company that has a quick ratio of 0.45.This means that:

A) the company has 45% of its total assets in the current category.

B) the company does not have the ability to pay off all the debt it owes with all the assets it owns.

C) the company does not have the ability to pay off all the debt that is due in the near future with assets that are available in the near future.

D) stockholders currently own 45% of the company's assets.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) An "A" rating is the best credit rating a company can earn.

B) Credit ratings below BB are called "junk."

C) A credit rating agency indicates a company's ability to pay its debts on a timely basis.

D) Moody's,Fitch,and Standard and Poor's are the names of credit rating agencies.

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Some bonds mature in installments.If a bond issue contains this feature,the bonds are known as:

A) secured bonds.

B) convertible bonds.

C) callable bonds.

D) serial bonds.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 145

Related Exams